Disappointing to see supermarkets put ahead of newsagents

As shown in this tweet to 36,000 followers:

Issue 109 is on sale now!

🚀Available from all good supermarkets and newsagents

🚀Get it on our app: https://t.co/DotBndry92

🚀Get our print & digital offers: https://t.co/umjl7sbQX7

🚀Retweet and follow us by 30 October to #win a copy pic.twitter.com/lHJYF5Xyro— All About Space (@spaceanswers) October 12, 2020

Pop Vinyls continue to deliver terrific new traffic in-store and online

The Funko Pop! Vinyl 2020 Fall Convention Limited Edition range released from embargo Saturday morning has worked a treat, thanks in part of cool social media content, which we made ourselves.

Pop culture is not category that is not for everyone. It requires constant work and has big business competitors. However, it is worth it, especially for the new traffic.

Yes, this is a long-standing newsXpress opportunity – not mandatory though.

What I like about the pop culture category is the diversity of the shoppers, their preparedness to travel to purchase and their happiness to also purchase online. Oh, and their shop efficiency – baskets often contain more than just Pop! Vinyls.

I’ve spoken with newsagents who say they don’t have these shoppers in their area. They cannot know that until they try and find them. It’s impossible to tell who may be a pop culture customer by looking at them.

For this category, it all depends on whether you want new traffic.

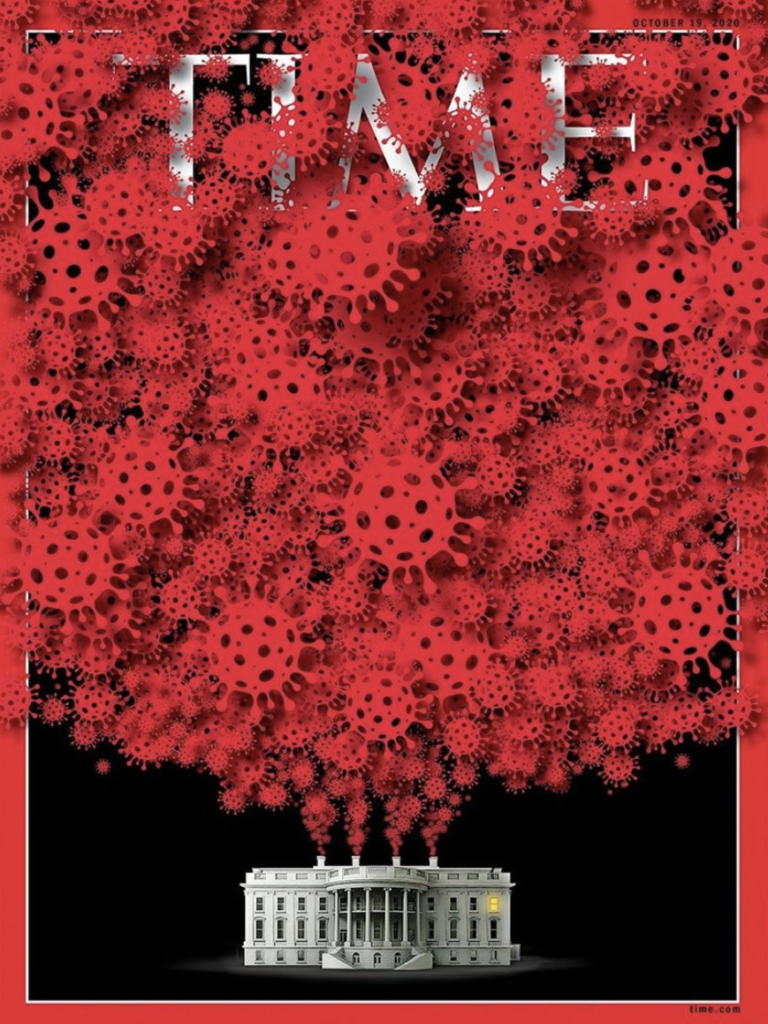

Kevin Rudd launches a petition for a Royal Commission into media diversity

Here is the official notice re this petition calling for a Royal Commission into media diversity, which could be called a Royal Commission into News Corp., which was launched by Kevin Rudd half an hour ago:

Petition EN1938 – Royal Commission to ensure a strong, diverse Australian news media

Petition Reason

Our democracy depends on diverse sources of reliable, accurate and independent news. But media ownership is becoming more concentrated alongside new business models that encourage deliberately polarising and politically manipulated news. We are especially concerned that Australia’s print media is overwhelmingly controlled by News Corporation, founded by Fox News billionaire Rupert Murdoch, with around two-thirds of daily newspaper readership. This power is routinely used to attack opponents in business and politics by blending editorial opinion with news reporting. Australians who hold contrary views have felt intimidated into silence. These facts chill free speech and undermine public debate. Powerful monopolies are also emerging online, including Facebook and Google. We are deeply concerned by: mass-sackings of news journalists; digital platforms impacting on media diversity and viability; Nine Entertainment’s takeover of the Melbourne Age and Sydney Morning Herald; News Corp’s acquisition (and then closure) of more than 200 smaller newspapers, undermining regional and local news; attempts to replace AAP Newswire with News Corp’s alternative; and relentless attacks on the ABC’s independence and funding. Professional journalists further have legitimate concerns around unjust searches, potential prosecution, whistle-blower protection, official secrecy and dispute resolution that should be comprehensively addressed. Only a Royal Commission would have the powers and independence to investigate threats to media diversity, and recommend policies to ensure optimal diversity across all platforms to help guarantee our nation’s democratic future.

Here is Rudd’s tweet, which includes a video explainer:

Australians have watched with growing anger at what the Murdoch media monopoly is doing to our country. A cancer on democracy.

Today I am launching a national petition to establish a #MurdochRoyalCommission.

If you value our democracy, please sign here: https://t.co/FjfK7ij7YQ pic.twitter.com/gIGfmMF49W

— Kevin Rudd (@MrKRudd) October 9, 2020

It’s a bold move to take on Murdoch as plenty have found. Personally, I’d like to see the proposed Royal Commission happen. I think it could be helpful for our democracy.

Newsagents promoted by publisher of Official Bathurst Program

The publisher of the official Bathurst program has been promoting newsagents on social media, which is terrific to see…

The 2020 Supercheap Auto Bathurst 1000 official program is on sale in newsagents now! The print and digital editions are also available from our online store. Details here: https://t.co/rEq7104XZf #VASC #Bathurst1000 pic.twitter.com/kGweFVXTw8

— SupercarXtra Magazine (@SupercarXtra) October 9, 2020

2021 Toy Fair to be 100% digital

The Melbourne Toy Fair slated for March 2021, usually a huge event, will be 100% digital next year. It’s good to see this announcement made early, so folks can plan.

The Melbourne Toy Fair slated for March 2021, usually a huge event, will be 100% digital next year. It’s good to see this announcement made early, so folks can plan.

This trade show has historically been critical for setting up the year for suppliers, harvesting plenty of forward orders. It has been a perfect opportunity for retailers to learn from first-hand contact about many new products.

This news about the 2021 Toy Fair, coupled with news of redundancies in other areas of trade show world, 2021 looks like a lean year for in person trade show events.

The suppliers who have pivoted to digital trade events and interactive digital catalogues are best positioned to benefit from the uncertainty of face to face trade shows.

It’s October and Westfield is yet to provide tenant Covid relief

Yes, it is a challenging time being a Westfield tenant. Despite all their noise and a truckload of paperwork, nothing. Meanwhile, experience with local small business landlords is excellent.

AC/DC coin set from the Royal Australian Mint driving traffic for the newsagency

At 8:30am yesterday the embargo on the new AC/DC boxed coin set was lifted and by this morning, in 24 hours, we had sold $2,750 worth of the set from one store. This, like other collectible coin sets is another net new traffic driver for the newsagency. 37% GP is good, especially where you can for sure turn all your stock a month before you have to settle the account.

Yes, this is a newsXpress sourced opportunity with access to a quarantined allocation, negotiated months ago, special pricing and terrific background information. The keys to success have been social media videos and photos, like:

And this one:

And photos like these:

Net new traffic is vital for our businesses. This is achieved through understanding. I know of newsagents who will say I don’t have coin collectors in my area. Thanks to a relationship with the Mint, I can for certainty say this is not true. mapping coin buyers by location is revealing. Also, people other than coin collectors buy sets like this.

A common response from newsXpress members getting into coins is that they are surprised at who purchases them.Besides lovers of coin magazines, newspaper customers are common purchasers of coin sets.

This AC/DC coin set is a success as it’s only been out a day. It will sell out.

And … here’s the pitch – this is a newsXpress success story. Driving net new traffic and delivering bankable profit for a safe outlay. Great news in 2020!

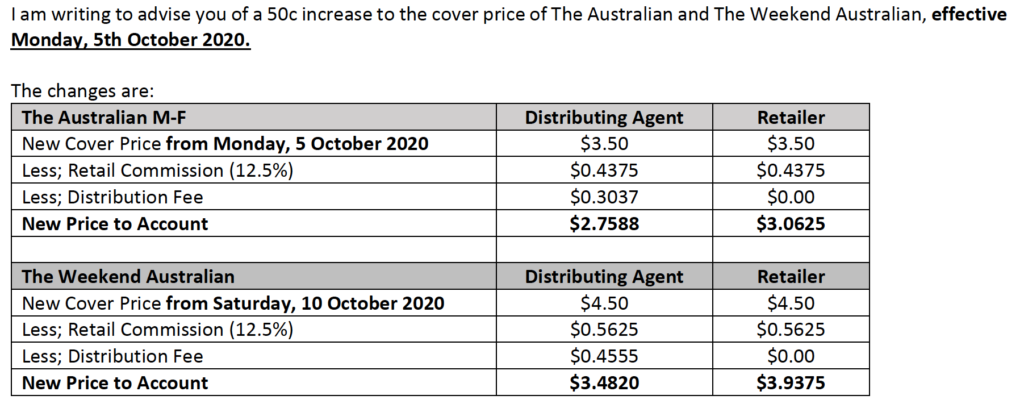

Some newsagents are yet to be advised about a price increase for The Australian, which kicked off Oct. 5

Communication from News Corp. has failed again with plenty of newsagents telling me they are yet to be advised of a price rise for The Australian and The Weekend Australia that started October 5. Here is part of the letter from September 28 I was sent by a newsagent yesterday.

The poor communication has cost some newsagents money given the poor approach to product data handling by the company.

This would never have happened 10 or 15 years ago. Back then, News Corp., folks made sure newsagents knew in advance as well as software companies – so that newsagents had the current advice a week before any cover price change. Now, with so much institutional knowledge lost in News Corp. it is no wonder newsagents who were not informed last week are furious.

News Corp. like to tell Australians how to live their lives. If only they sorted their mess out first.

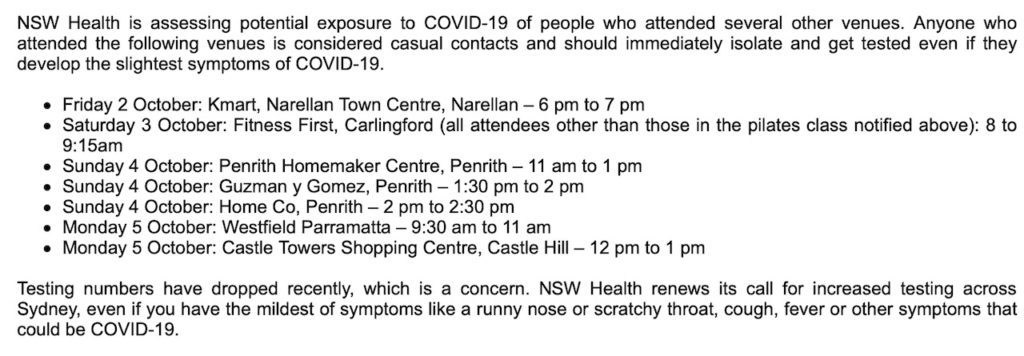

Shopping centres in the firing live over covid

Chadstone shopping centre in Melbourne has been the top of the news over the last week following a cluster outbreak from a business in that centre. yesterday, NSW Health issues this notice:

This notice lists more shopping centres. These notices must play into shopper confidence that the centres are safe to visit, which impacts visitror numbers as well as shopping time while in a store.

The notifications remind retailers of the need to run Covid safe businesses and to do this with discipline.

Ensure you are on top of JobKeeper 2.0 requirements

With JobKeeper 2.0 now in play, it is critical that anyone with employees reviews the JobKeeper business eligibility requirements as well as employee entitlements as to the appropriate tier. This is critical to ensure people are paid correctly and to ensure that you have the necessary information to better inform rostering decisions.

While the ATO website contradicts itself, click here for what I am told is the correct tier eligibility requirements.

Here are the key dates for JobKeeper 2.0:

- September 28: start paying eligible employees under the second phase two-tier system, based on their hours worked in the comparison period.

- October 1–14: complete your October JobKeeper monthly business declarations.

- October 1–31: prepare and submit your business turnover decline to the ATO.

- Before October 31: ensure you’ve met the wage condition for all JobKeeper eligible employees from the fortnight starting September 28.

- From November 1: complete your monthly business declaration and confirm payment tiers you are claiming for each eligible worker.

The Paperboy website

The Paperboy website provides access to the front pages of newspapers from around the world. The site gets around 1,200 visitors a day from Australia and around 46,000 a day worldwide currently.

The Paperboy website provides access to the front pages of newspapers from around the world. The site gets around 1,200 visitors a day from Australia and around 46,000 a day worldwide currently.

I don’t see it as a threat to over the counter sales.

A newsagent contacted me yesterday about the site, worried that it was another risk point. The reality is The Paperboy has been around for 2 decades.

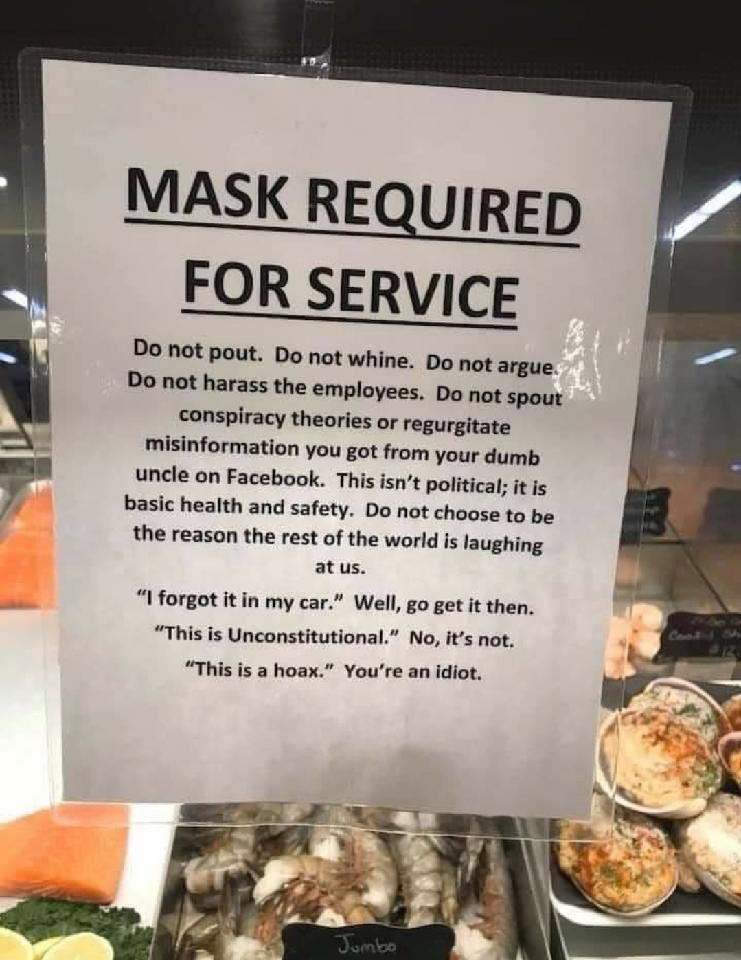

Masks will be here until there is a COVID-19 vaccine

The mask requirement in Victoria got off to a shaky start with some nasty scenes in retail. As time has gone on, it’s become easier to manager, shoppers have been more engaged with the requirement.

Thinking about this and the now clear value in mask wearing, it is a good time to consider how we in retail can better manage the mask requirement – for the safety of everyone in our shops, especially for those to whom it is a work place.

This tweet about mask and temperature checking in Thailand shows a smart and efficient way to handle masks as the entrance to the shop.

My local shops in Thailand. In 2 seconds scans my temperature and to see if wearing mask. Doors don’t open if not. 3 cases in 100+ days here. Removes awkward mask arguments for staff as well. pic.twitter.com/4Eac5fMsLR

— Niall Harbison (@NiallHarbison) October 4, 2020

If you scroll down the tweet thread, you can see this video from a school in Scotland:

Some schools have them here in Scotland pic.twitter.com/iurh5Q80wr

— Gav Gordon (@GavGordonToGo) October 4, 2020

We are using social media to appreciate people wearing masks.

Tabcorp (Tatts) Terminal connect released for newsagents

Following acceptance testing and beta testing, the Tabcorp (Tatts) Terminal connect facility is released in the Tower newsagency software, offering retailers the ability to call up lottery terminal sales into the POS software.

This is in a new release of the Tower software out today. It will be interesting to see how much newsagents use the facility.

The process is simple:

Sell By Scanning Customer Trans. Receipt Barcode

Sell By Scanning Customer Trans. Receipt Barcode

Once you have completed the sale on your lottery terminal go to your POS Register

Locate the Customer Transaction Receipt. It should look similar to the example opposite.

Scan the barcode on the bottom of the Ticket.

Your POS screen will then be filled with the ticket included in the sale.

This text above is part of the broader, more complete, documentation released by Tower. I am sure other newsagency software companies will publish their connectivity advice.

Stationery sales stalled in newsagencies?

I’m currently collecting data for a July – September 2020 newsagency sales benchmark study. While the process is in its early days, with data from 30 businesses in so far, already I am seeing concerning data for stationery with sales down, against an overall trend for the businesses.

I have data for one business where overall revenue is up 13% while stationery revenue is down 9%. In another case I can see revenue up 9% but stationery revenue down 12%.

While stationery has been challenged in the channel for a few years, these results are worse than the trend. It’s concerning.

Newsagency sales benchmark study launched

Yesterday, I launched a new sales benchmark study to newsagents. This study looks at the Q3 2020 results.

I am collating data for a new benchmark study, looking at sales July through September 2020 versus 2019.

How to participate.

- Please run a Monthly Sales Comparison Report for 01/07/2020 – 30/09/2020 compared to 01/07/2019 – 30/09/2019.

- Tick the category box. IMPORTANT.

- Tick to exclude home delivery and sub agent data.

- DO NOT tick the supplier box.

- Preview the report on the screen. Save as a PDF.

- Email these reports direct to me at mark@towersystems.com.au.

- Read the report yourself and see what it shows you about your business.

I will email the results to all participating newsagents and publish the results on theAustralian Newsagency Blog as a service for all newsagents.

I own and run three newsagencies. Over the years I have had three others. I own newsXpress, the newsagency marketing group.

I am grateful that Tower Systems has added 30 newsagents as customers in the last year as customers of our newsagency software,

How much space do we need for magazines in a newsagency now?

How much space do you suggest I allocate for magazines in the newsagency? This question came to me last week from someone establishing a new newsagency.

My standard answer today is that you need between 300 and 500 titles to offer a reasonable assortment today. The more accurate answer will depend on your situation. In regional locations, for example, the number would be higher, around 700.

In capital city shopping centre locations, like this photo that I took in one of my Westfield businesses Thursday last week, we are on the low side for range.

In this business, however, this space does well. It is rare we are asked for. title we don’t have. The sales declines in the store are not outside the channel average.

This store used to have three times as many titled two years ago. That space has been given over to higher GP lines such as gifts and collectibles, better traffic drivers than magazines.

Magazines do have their place and having a reasonable range to satisfy local demand is key.

The other question people ask is display. I like the fun face approach we have in this Westfield store. It is easily shopped. The full cover gets to sell the title. Titles can be ‘browsed’ without being picked up, which matters today.

I like placement on the back wall as browsing does not interrupt other shoppers, and it acts as a beacon – it can be seen from outside the shop.

Anyone establishing a new newsagency needs to make sure they do have space allocated for magazines and appropriate shelving for pitching product. While the margin is paltry, it is a category that has some value for the shingle.

Oops: newspapers forgets lotto numbers

A terrific tweet from Lomas News, a UK newsagent:

The Mail forgot to print tonights winning lottery numbers again…. pic.twitter.com/9xowjGBwA7

— Newsagent (@LOMASNEWS) October 3, 2020

Some retail businesses are having an awesome 2020

I wrote this article a few days ago for a publication and share it here because I know of some newsagents who are having an awesome 2020 and who feel uncomfortable talking about their success. Kudos to newsagents having a good 2020. This is success you have made for yourselves!

…

Some retail businesses are having an awesome 2020

Yes, some retail businesses are having an awesome 2020, plenty in fact. However, most of those having success this year do not want to talk too much about it. They want to keep a low profile because most of what’s in the media about business in 2020 is negative and they do not want to distract with what they think is a unique good story. Some even feel ashamed at their success.

The reality is that many retail businesses, especially local small retail businesses, are having a good 2020.

Yes, there is excellent good news out there. Here are some good news stories we see in our work with specialty retail channels, without identifying store details. These are channel-wide stories with many businesses in each channel having success.

- Garden centres are doing very well, offering customers the ability to grow their own produce, be more self sufficient, eat more healthily. Many garden centres we are working with have been challenged to keep up with demand. They have risen to the occasion, helping many folks into their first ever veggie patch.

- Farm supply / rural produce businesses have had a big and successful year. Sales are up as more people are living in regional and rural locations and needing more materials as they work on their properties in these locations.

- Toy shops are doing well helping people enjoy their time at home. Those who engaged online have done especially well. Those that expanded their jigsaw, game and relaxation product ranges have done well.

- Pet shops have done well as pets have become even more important this year, offering comfort and company, making isolation easier.

- Bike shops are having a terrific year as they offer people enjoyable ways to remain healthy in a safe way.

- Fishing and outdoors businesses are doing well, too, thanks to their ability to help people be more self sufficient for food.

- Newsagents are having an awesome 2020 as they have become more relevant through offering essential services, keeping people informed and helping people enjoy home time more through their games, jigsaws, crosswords and more.

We know many small local and independent retail businesses that have done so well that they do not qualify for government pandemic assistance. Double digit growth in 2020 is real for them. They are loving being in business and serving their local community. They are loving that local shopping is more popular in 2020 too.

So, while the TV news and current affairs programs focus on stories of doom and gloom, there are many, hundreds and thousands of good stories, happy stories, stories of growth and success in small business retail … stories of success in 2020.

For many of the business owners enjoying success this year, they have made it happen through their decisions and actions, they have pursued success and for this they have every reason to be proud.

Well done to all of these small business retailers having an excellent 2020, well done!

We are grateful to be part of this, part of the community of businesses having a good year. We are thankful that through what we make we are able to play a role in helping retail businesses find and nurture success.

Now, if only media outlets could share some of the good news stories. They done;t have to look far to find them.

Spreading happiness from the newsagency counter

We have partnered with an awesome local chocolate maker to source these inspiring and tasty chocolates, which are placed at the counter.

As you can see, each chocolate is wrapped with a message of optimism and inspiration.

Customers are invited to help themselves.

We also encourage them to do this and to take some to mass on the joy.

People love the something for nothing, the tasty chocolate and the messages wrapped on the chocolate.

Reject Shop struggling with card supply?

Several Reject Shops I have seen in Melbourne have been out of stock of plenty of cards for weeks.

Several Reject Shops I have seen in Melbourne have been out of stock of plenty of cards for weeks.

With their cards imported through a relationship with the Card Factory in the UK, I wonder if they have Covid related supply challenges. The empty pockets were noticed prior to the Sydney port issues.

Hopefully, the empty pockets are giving nearby newsagents a boost in card shopper traffic. I have a couple of stores in this situation – it’s how I first noticed it a week ago.

I’m told the empty card pocket situation is not evident interstate.

Somewhat related … I am surprised The Reject Shop is open during Melbourne’s Stage 4 lockdown. I can’t see anything in their aisles that denote them as essential.

Shipping delays may impact Christmas sales

As I mentioned in an earlier post, Christmas is well under way with terrific card sales already in plenty of businesses.

Some suppliers, however, are experiencing delays in shipping Christmas product, delays of 2 to 4 weeks depending on the supplier. These delays challenge business for those suppliers as retailers are already looking for alternative suppliers.

With Christmas alive right now, it’s appropriate retailers make the move.

Lotterywest and Jumbo working together for online lottery sales in WA

Lotterywest yesterday updated its retailers on a new relationship with OzLotteries operator Jumbo:

Working on a solution for WA

As you know, Lotterywest and Jumbo Interactive Limited have been discussing a solution that will benefit the Western Australian community, and see funds previously leaving WA through ozlotteries.com returned to our State.On Tuesday 29 September, Jumbo signed a binding Term Sheet with the intent of entering an Agreement that will provide Lotterywest with its online platform and services for an initial three-year term.

This means that existing Jumbo WA online players will be given the option to become Lotterywest players after accepting the new Terms and Conditions, and continue playing Lotto games on a platform they’re used to.

This arrangement helps maintain their current playing experience as much as possible, and will also ensure all available profits from tickets remain in WA to support our community. We’ll now work with Jumbo to transition these WA online players to the new platform by 21 December 2020. We’ll keep you updated as more information becomes available.

This is an important move in WA in terms of preserving lottery purchases from WA customers in the state. It also offers the potential for a better connection for WA lottery retailers with online.

Customers appreciate environmentally-friendly packaging changes

Customers are commenting positively about the elimination of plastic from boxed Christmas card packaging.

Customers are commenting positively about the elimination of plastic from boxed Christmas card packaging.

Several suppliers have made the move and it is being noticed. It is also helping drive sales as people can feel the cards. For some treatments this seals the purchase.

Full face placement leverages the tactile opportunity presented by the open boxes.

While we have used social media to pitch the better environmental story, it is in-store where the change is noticed.

Boxed Christmas card sales are strong in our experience, considerably ahead of this time last year. I think Covid is a factor in this. Indeed, I suspect Covid will be a factor in Christmas card sales overall to be up this year compared to last year. I know we are not alone with this experience, which is terrific.