Ovato on magazines

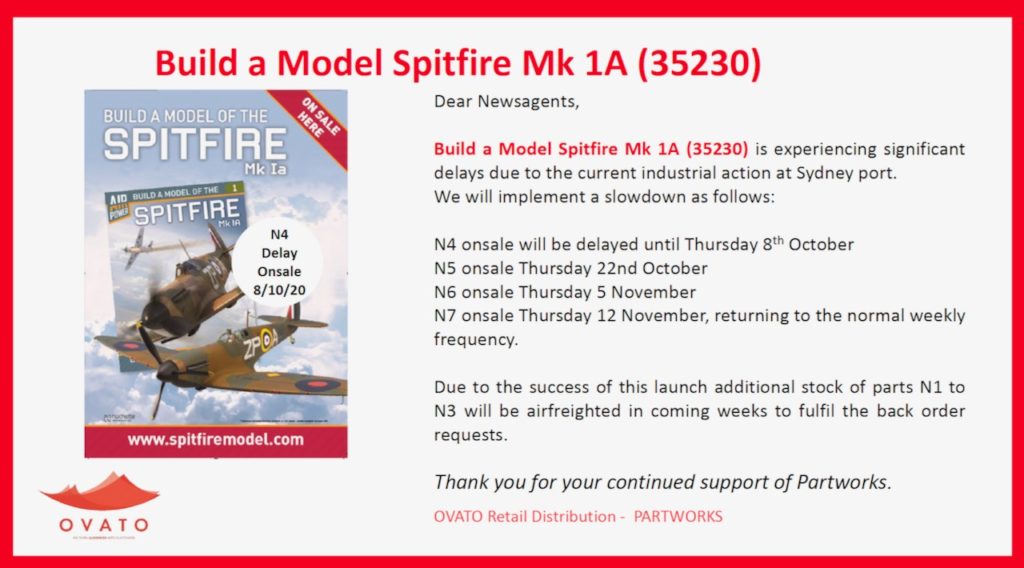

Ovato wrote newsagents with an update on magazines…

Firstly we are pleased that only a handful of stores are still closed due to the impact of COVID-19 and the general feedback is that newsagents have performed well during this period considering the varying circumstances in each state, region and location.

Magazine sales in newsagents over the last 6 months from the XchangeIT data indicates there has been a significant slowdown in the overall decline year on year from -11% to -5%. With people moving around less they are relying on their local businesses within their suburb to do their shopping. There is little doubt this is contributing to strong magazine sales results, especially in local shopping centres and regional outlets. We have posted a short article on our social media outlets to re enforce the popularity of magazines over this period if you are interested.

https://ovato.com.au/ContentHub/Article/Consumers-turn-to-magazines-for-inspiration-148

Magazine categories showing strong growth in newsagents during COVID-19 are below and we will be sending an updated Magchart in Oct highlighting the top selling titles in each category to see if you have any ranging gaps.

Children +33%

Craft +16%

Food and Drink +36%

Home Interest +23%

Puzzles +19%Although magazine sales have performed well the advertising market continues to be challenging and some publishers, both locally and internationally have had to make the difficult decision to close or reduce frequency of their magazines. Also given the closure of international travel in March we also had to halt the importing of air-freight magazines. We don’t expect these 200 magazines to return until July 2021 at the earliest.

We are also currently seeing an impact in reduced supply of our UK and US sea freighted titles. Initially we had good levels of supply due to the delay in shipping times, but in recent months we are seeing a reduction in supply levels as many international publishers suspended titles or reduced supply through March to June. This was most evident in the UK as most high streets and shopping centres were closed for an extended period and publishers hibernated titles.

Although we are now seeing a return to normal supply levels ongoing industrial action at Port Botany in Sydney is impacting our delivery schedules and we are now experiencing delays of up to 3 weeks on receiving containers and this is impacting us replenishing new titles to you. We are currently reacting to these changes and unloading some containers down in Melbourne to help improve supply levels through October.

Are Media, formerly Bauer, putting magazines in Australia Post and Aldi

From Mediaweek today, Are Media CEO Brendan Hill on a move that will harm newsagents.

Hill revealed that the business has been working on expanding its retail partnerships. “We have just done a deal with Australia Post to trial magazines after all the foot traffic increase from people picking up parcels. We have also done a deal with Aldi to sell the kids’ magazine Bluey. It’s the first time Aldi has sold a magazine and hopefully it might be the start of further opportunities with them.”

Here’s what we know, magazine sales are in decline. While there was a Covid bump, it is shown to be over in states where there are minimal movement restrictions. Last year, unit sales of magazines over the counter in newsagencies were down around 12%. We know from Ovato’s annual report that the decline was considerable across all magazine retailers.

Outside of Covid, based on current basket data, magazine sales will decline this year too.

Newsagents were essential, remained open all through, serving magazine customers and publishers. Many remained open and losing money. The timing of Are Media bringing on yet more retail outlets is disappointing.

Newsagents have put up with years of minimal change to magazine cover prices, meaning that the real GP contribution from magazines has been falling even more than the decline in unit sales.

But that has not stopped the experts at Are Media from thinking magazines should be in more locations. This is a move that will harm newsagents no matter how the Are Media people try and spin it. It does not make sense to me.

Thanks for supporting local small business retailers in Australia Are Media!

Now we know where we stand.

Is it reasonable to wonder if the Australia Post move is the company considering a move away from our channel. I ask because we know that magazine distributor Ovato wants fewer accounts, not more.

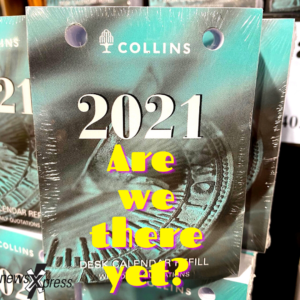

A different approach to desk calendar marketing

This social media post I created in a couple of minutes a few days ago has provided a bit of fun. I like it because it’s not the usual oh, look at what we have in the shop for you to buy. This taps into the Corona related challenges in Victoria of recent months and the wish for 20201 to be better – without sounding all whiney about it.

This social media post I created in a couple of minutes a few days ago has provided a bit of fun. I like it because it’s not the usual oh, look at what we have in the shop for you to buy. This taps into the Corona related challenges in Victoria of recent months and the wish for 20201 to be better – without sounding all whiney about it.

Richard Glover on his newsagency experience as a kid

In the pages of Spectrum from the SMH and The Age last week was How porn and a price hike helped this newsagent’s son, a terrific short memoir from Richard Glover about his experience as a son of a newsagent.

It’s a good read. My only wish is that he reflected on newsagencies today as they have come a long way from his memories. Glover wrote:

These days, newsagents rely on gambling, working away at counters in which the air is heavy with scratch-lottery dust. They struggle on – despite falling sales of almost everything on which we used to rely – cigarettes, greeting cards, newspapers, pornography and the long-banned headache powders.

I’d prefer:

These days, many newsagents have evolved from the days of my childhood memories. On the high street they are often the retail innovator, selling gifts, and homewares, supporting local Aussie makers and helping us connect with loved-ones in ways never dreamed of in the 1970s.

The Aussie newsagent is a quintessential business. It’s terrific to see that so many have evolved with the times.

Like many, I have not relied on gambling in my newsagency businesses for more than 10 years.

I wish people writing about our channel did more research to understand the extent of evolution from just a few years ago.

What does newsXpress offer newsagents?

Ten days ago I hosted a Zoom meeting with some of the newsXpress head office team members to talk about some of what newsXpress offers its members. In the video below you can hear from the diverse and skilled group behind newsXpress member support. What’s discussed is only part of what newsXpress offers.

As I have offered before, I’d be happy to share similar insights from other groups.

Local retail and hospitality businesses in dispute over use of parking for outdoor dining

There is a fight brewing in some towns between cafe and restaurant owners and retailers. The fight is over car parks and the proposal that they be used for outdoor dining. It is pitting business owner against business owners.

Local councils and tourism bodies appear to preference the re-purposing of car parks for dining, impacting accessibility for nearby retail businesses.

I am aware of a situation where the plan is to remove all street car parking in front of one newsagency and several shops so that a cafe located behind can serve meals and coffee on the street.

I am aware of another situation where a florist business that depends on the three car parks in front of their business for easy customer pick up is set to lose them for a cafe outdoor dining area.

While meetings have been held, there currently appears to be no easy solution.

While, for sure, hospitality businesses have done it tough through Corona, harming the prospects of other businesses solely for the benefit of hospitality businesses does not appear to be fair with those impacted businesses set to lose revenue.

This is an issue that requires thoughtful engagement by the business owners, local councils and other bodies that have a stake in resolution.

I don’t know what the answer is, I do winder if one solution could be to reconsider how the cafe indoor space could be adjusted to make it safer and therefore reduce the reliance of such businesses on car parks for outdoor space.

Further, thinking about some regional towns, there are areas of beautification on the Main Street – large median strips, garden areas with benches and more – that could be replaced with outdoor dining options and thereby reducing the impact on car parking.

Local high street retail relies on ease of access by car. Newsagents have seen the value of this especially since March this year. Top reduce or remove this amenity could negatively impact those retail businesses.

I urge any newsagent who may be impacted to actively engage with council and other bodies involved in decision making. Ensure that your voice is heard and that the possible impacts to your business are understood.

With many of these decisions being considered for weeks and even months out, now is the time to engage on this if it looks like you could be impacted.

Terrific social media resources from 3M

Click here to access awesome social media resources you can use to pitch 3M products. The resources have been created by 3M for retailers of their products.

Click here to access awesome social media resources you can use to pitch 3M products. The resources have been created by 3M for retailers of their products.

With giftwrap tape, double sided tape and Scotch Magic Tape selling well this time of year, pitching on social media is timely.

The folks at 3M participated in a Zoom meeting with newsXpress members recently, sharing tech insights into the product, which will help drive sales. A couple of key takeaways from that session are: place the products with wrap and at the counter and, maintain stock levels as many retailers sell out early in the season and can’t get replenishment stock.

It may not seem like great use of time or resources to focus on tape. However, it’s a good margin impulse purchase that can add tangible value to the basket. The business is there for you to grab through simple and low-cost options.

If Australian jobs matter to you and your family…

I wrote this article for my POS software company’s blog a few days ago. I share it here as I think it is relevant to any business owner keen to drive support form local shoppers.

If Australian jobs matter to you and your family…

There is plenty of talk from politicians, in the media and on social media about the need to create local jobs, in Australia, for Australians, about the need to provide opportunities for job growth.

Too often, the talk is the end of it, the talk is only talk.

The best way to create jobs is to buy locally. However, buying locally applies to all of us, including us in business. We need to buy locally as much as possible.

While I am not an economist, I think I am right in saying that the more of our money that we spend entirely pithing Australia, the more the Australian economy benefits and the more local jobs that will be created.

This is why in the retaIl shops I own we preference Australian made. Now, by Australian made we do not mean the products that limp over a line that says a percentage of the product has to be from Australia. No, we want the whole thing made here if at all possible as it is this that adds real value to our economy.

In our own business where we develop POS software, our biggest competitors are overseas companies that spend huge sums promoting through search engines and social media. We don’t spend dollars advertising on those platforms. Our investment is in our people, our software designers and developers, our help desk team, our admin people, Australians who will spend their pay check in the local economy with that spend helping the types off businesses we sell to.

To us, this is what shop local looks like. It is about understanding your place in the economy and knowing that your buying decisions can make a difference to other local businesses and hopping that those in control off those other local businesses support more local businesses.

The ripple effect of shopping and sourcing locally can be wonderful not only for the individuals benefiting but for the whole local economy.

The importance of this is something we leverage in our POS software by providing retailers easy ways to indicate locally sourced products, to help them in their shops and online to shine a light on locally sourced products. We have coded these tools into the software to make it easier for local retailers to monetise locally sourced products.

Shop local to us is much more than a poster or a slogan. It is about active decisions we make that help other local businesses, in the hope that their decisions, too, help other local businesses.

Now, if only politicians went beyond lip service on the shop local front, if only they actively engaged in this in terms of their personal spending and any spending then engage in on behalf of their constituents.

The real power in the shop local discussion is in the dollar. Spend the dollar in your hand locally and you make a powerful, and appreciated, contribution.

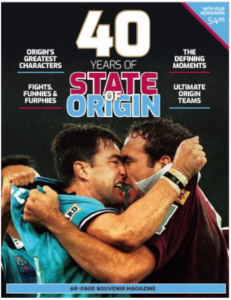

News Corp. offers newsagents 37.12 cents for each copy of 40 years of State of Origin

Retail newsagent who stock the 40 years of State of Origin magazine from News Corp. will make 7.5% of the cover price for each copy sold.

Retail newsagent who stock the 40 years of State of Origin magazine from News Corp. will make 7.5% of the cover price for each copy sold.

Shame on News Corp. for this.

For a company that shouts daily from its print and digital platforms on many matters including telling others what to do and how to lead, here they are giving newsagents not even a living wage to support this title.

Retail newsagents will make 37.12 cents from each copy sold. For this compensation, they will have to:

- Unpack the title.

- Check supply against the invoice.

- Create space to display the title.

- Place the title in retail.

- Maintain space for the title for up to eight weeks.

- Scan each sale.

- Take the title off in early December.

- Count returns.

- Physically process the returns.

- Fund any theft of the title.

37.12 cents a copy for all of this investment by newsagents!

A few newsagents I have spoken with expect they could sell 10 or 12 copies of the magazine. For that they will receive around $4.00. They also said that handling everything necessary that is associated with the title will cost around a man-hour, maybe more.

$4.00 an hour is appalling. The current, non Covid, unemployment benefit paid by the federal government calculates out at around $4.87 an hour. With this 40 years of State of Origin magazine from News Corp., the company is paying less than the unemployment rate.

That’s how much News Corp. values small business newsagents, that’s how much the company cares for them.

On the from cover of The Courier Mail, News Corp. claims we’re for you. They are not, though, they are certainly not for newsagents and all who rely on a newsagency business for income.

So, how much should newsagents be paid to offer this title? The gross profit from the 40 years of State of Origin magazine should be at least 45%. While that would not make it profitable for newsagents, it would at least demonstrate respect for newsagents and their investment of labour and retail space in supporting the title.

The current low margin arrangement for print product continues poor and disrespectful treatment of newsagents by publishers. Newsagents putting up with this treatment allow it to continue.

Newsagents only make money from what they sell. Publishers make money in a range of ways from a print title.

Publishers will complain that they don’t make enough to give newsagents a better margin. That is not the fault of newsagents. Newsagents have fixed labour and space costs. They increase yearly. Publishers need to respect this if they want the channel to continue. They current approach to compensation is a factor in some newsagents quitting the channel.

Screen advertising in a newsagency?

I’ve heard of some newsagents receiving a hard-sell recently to put an advertising screen in their shop.

Our retail channel has a track record of failure with such screens. I am not aware of any over the last 20 or so years that have worked, from the Bill Express screen on.

In my shops I want less visual noise, not more. Also, I want to promote what I sell, not what other businesses sell.

I told the sales person who called me no thanks. They persisted. I said no thanks again. They hung up and called again. Still, no thanks.

If you are going to do digital screens in-store, they needs to be seamlessly integrated into your business, carrying your message through professionally produced content, that works for you. That takes tens of thousands of dollars to deliver.

Recent Covid infections an important reminder to retailers

Recent infections in several states where retail businesses and shopping centres have been named are a timely reminder to all retailers to manage Covid safe businesses. Here is the approach we continue to follow in my own shops:

- All staff wear masks with masks available at no cost from the business.

- Hand sanitiser for staff at the counter and encouraging its use. Ideally, a sanitiser that does not dry skin.

- Hand sanitiser for customers at entrance and at the counter.

- Perspex screens remain in place to provide a protective barrier for shoppers and staff.

- Regular cleaning of main touch-point surfaces in the shop from the entrance through to deep into the shop.

- Thorough clean after close each day including disinfectant surface clean.

- Encouraging payment by contactless card.

- Maintaining a smooth traffic flow with a designated entrance and designated exit.

- Only using government issued signage in-store.

- Reminding people through social media about the commitment of the business to safe shopping.

- Continuing with the curbside pickup offer.

- Continuing with the free local delivery offer for people in need, who cannot easily personally shop.

These steps have helped ensure consistent access to the workforce and good traffic flow from shoppers.

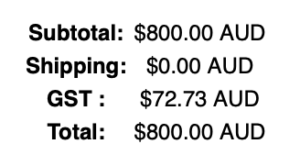

What we did to get an $800.00 online sale yesterday at 1:33pm from a shopper interstate

We received an online order yesterday in one of my newsagencies at 1:33pm worth $800.00. It was one of 12 online orders for that business, yesterday totalling $1,800 in value.

We received an online order yesterday in one of my newsagencies at 1:33pm worth $800.00. It was one of 12 online orders for that business, yesterday totalling $1,800 in value.

Each one of these orders is a pre-order – fully paid for up front for stock that is another week away from arriving in-store and two months away from being paid for by us.

The specific products are not relevant to this post as what I share below could apply to plenty of products and product categories. What we have done in this two and a half year old business is what anyone could do and what I know several newsagents are doing to win online sales.

- Create your online presence as a start-up business. My recommendation is that you not take your existing shop online under your existing shop’s branding.

- Choose a product niche or category that is sought after, that is being searched for. This could be a brand, a licence, an end use or some other segmentation that makes sense to the shopper.

- Look for brands and categories people could be loyal to for some time.

- Source key suppliers. Preference suppliers who might work with you on geographically exclusive items.

- Register a domain and business name that speaks to the shopper for the chosen category.

- Develop your approach to packaging and shipping, remembering that this process has to be delivered as a brand extension. Add value here and you will bring them back.

- Create a site that serves the shopper.

- Include on the website unique knowledge / information that lifts you up as an expert in the product category field.

- Include a chat facility on the site, so you can answer questions from people who do not want to email or call with their queries.

- Create a separate Facebook page to support the website. Regularly feed contact to that page, content specifically for that page.

- Ask your suppliers to link to your website and appreciate them for any promotion they offer on their social media pages.

- Search out other social media pages that reach your target shopper and engage with those communities.

- Email shoppers, appreciating their business. Find ways to remain connected with them as this connection can help bring them back.

The first step revenue goal with online for any business entering that space has to be 5% (or less) of total revenue. Once there, the next goal is 10%, then 15% and so on. Goals are important.

Treat your online business as a start up. Manage it as such. Embrace mistakes and failures as they are the foundation bricks to success – cliché yes, but true.

Do you have to stock in your shop products you sell online? No. I say this as many retailers think the answer is yes. Seriously, think of your online business as a start up as doing this frees you up to be more open to what you sell.

Can I put my shop online though? Of course. It’s 100% up to you.

Isn’t shipping hard? Offer what enough people want and shipping can be resolved by building it into the price or you looking at online as cream sales, sales from which you can give up some margin.

My newsagency software company develops websites for newsagents. While what I have written here does relate to the online success at my high street newsagency, it is the same advice I provide all newsagents who contact Tower Systems querying about website development.

The Saturday Paper in Coles

The Saturday Paper is being made available through Coles, which is frustrating some newsagents. This respected title has been in our channel for 5 years. Newsagents have supported it even though the margin is slim. It is disappointing some that Coles now gets the title.

Newsagents have been asked by IPS to deliver bundles to Coles for a $5.00 drop fee. I’d be surprised if many agree to this.

Free newsagency marketing session today

Today @ 10:30am I’m hosting an open forum @ 10:30am to outline what newsXpress offers and how it works.

While I am primarily doing this to record and share via video, anyone is welcome to join to listen or ask questions.

With interest in newsXpress among newsagents and suppliers strong, it feels like a good time to offer this session.

Here are the details for joining in – anyone is welcome:

https://zoom.us/j/99657147413?pwd=dmhaa2VHK0pyb1M1bHZSeUxOMDNLUT09

Meeting ID: 996 5714 7413 Passcode: 081628

Scramble for alternatives to China sourcing

Importers are scrambling to find alternative sources for products they currently source out of factories in China.

The latest challenges with 2 Australian journalists fleeing China, Australians working in China advised by the Australian government to leave, the continues crack-down in Hong Kong and the greater focus on the plight of the Uyghurs is driving this.

Already, we have seen some suppliers shift product sourcing to Australia. I know of several suppliers who are driving the setup of production facilities in other low labour cost countries.

A challenging factor is in competitive situation. Currently, competing suppliers who source from China have a relatively consistent cost base. In moving production from China to another country there is, naturally, an impact on cost.

No slowing of jigsaw sales in newsagencies

With supply challenges all but resolved, sales of jigsaws are strong in newsagencies that have decided to continue with this category. Having an evolving range is key as is overing over the phone purchase as well as online purchase. Jigsaws also continue to be a popular locally delivered item. This has been an excellent category for us this year.

With supply challenges all but resolved, sales of jigsaws are strong in newsagencies that have decided to continue with this category. Having an evolving range is key as is overing over the phone purchase as well as online purchase. Jigsaws also continue to be a popular locally delivered item. This has been an excellent category for us this year.

Newsagency marketing group open forum: This is newsXpress

Tomorrow, Tuesday, I’m hosting an open forum @ 10:30am to outline what newsXpress offers and how it works.

While I am primarily doing this to record and share via video, anyone is welcome to join to listen or ask questions.

With interest in newsXpress among newsagents and suppliers strong, it feels like a good time to offer this session.

Here are the details for joining in – anyone is welcome:

https://zoom.us/j/99657147413?pwd=dmhaa2VHK0pyb1M1bHZSeUxOMDNLUT09

Meeting ID: 996 5714 7413 Passcode: 081628

In the meeting I will be joined by a new products expert who will speak to net new traffic generating products, a millennial shopper expert who will speak to attracting that type of shopper and a data expert who will speak to how data can drive profitable business decisions.

newsXpress is grateful to have welcomed new members to the group over recent months, adding to this community of newsagents keen for new ideas and happy to embrace a culture of optimism.

Religious Christmas cards lead in early Christmas 2020 sales

Even though the Christmas card season for 2020 has barely started, we have enough data to indicate that, once again, religious card sales will lead this year.

Even though the Christmas card season for 2020 has barely started, we have enough data to indicate that, once again, religious card sales will lead this year.

Indeed, some religious designs have been so successful rely that we have reordered already as we will have sold out in the next week or so.

I suspect that this year we will see terrific growth in Christmas card sales, in singles as well as boxed. I suspect, too, that we will see even greater growth in religious Christmas card sales – based on the early results so far.

For us, having Christmas cards on the lease line is key, as is having a small and changing selection at the counter. These placements along with an occasional pitch with newspapers and a pitch on social media combiner’s to drive good results for us. I’d also add that we have seen terrific sales online, too, with customers adding a box or two of cards to other purchases.

While it’s early, I’m hoping for somewhere between 10% and 15% year on year growth in unit sales of Christmas cards.

Now, for anyone thinking it’s too early to talk about Christmas 2020, we know for sure that some majors like Kmart kick off Christmas 2020 in just over a week so being ahead of them with cards and other Christmas items is useful in serving the organised early shopper.

Stage 3 grants now open for Victorian businesses

Newsagents in Victoria can now apply for stage 3 cash grants from the government. The process is straightforward and the data required is not onerous.

The key data points are: ABN, Workcover employer number, revenue in FY2019/20, when you applied for JobKeeper, number of employees, number of full time, weeks on JobKeeper.

Click here to go to the Business Victoria detail page about the stage 3 grant.

Helping newsagents deal with XchangeIT emails

XchangeIT sends emails telling newsagents they have failed on data related measures set by XchangeIT and expect newsagents and their software companies to fix the issues – even though the benefits of doing this are questionable.

Last month, I got together with a couple of experts at Tower to talk about common reasons why XchangeIT may send the emails and how newsagents using the Tower newsagency software can resolve the issues. Here is a video of that session. I’m sharing it here because feedback is that it has helped newsagents reduce the XchangeIT reported issues.

Why I’m not supporting National Newsagent Week in my shops

National Newsagent Week kicks off tomorrow. It’s a supplier driven week of competitions and promotions designed to support retail newsagents.

National Newsagent Week kicks off tomorrow. It’s a supplier driven week of competitions and promotions designed to support retail newsagents.

While I think there is merit in shining a light on locally owned and run businesses, like newsagencies, this campaign misses the mark.

Take the collateral, it feels like something from the 1980s. It’s not an image relevant to 2020.

2020 has been a landmark year for the newsagency channel yet the creatives behind this campaign for some reason decided to not lead with that. Instead, on the website, they have used a stock image that speaks little to newsagency businesses.

If I was running this campaign, I’d have lead with Covid and the response from newsagents and the gratefulness felt by newsagents for the support of their local communities. I’d have included iso resources people could use along with other support materials that support the essential nature of newsagency businesses through Covid.

Every image on my website would be real, from real newsagency businesses, reflecting the unique role newsagents play in their communities and the valued role the channel has played in 2020. It its heart, my website would be a celebration.

2020 has been the year of the newsagent.

- We helped keep people informed.

- We have served local communities through Covid with shopper safety top of mind.

- We have helped people relax by offering awesome jigsaws, crosswords and maker craft items.

- We have helped homes remain calm by sourcing beautiful Australian made candles.

- We have shone a light on local makers giving them retail outlets for their creativity when local markets closed down.

- We have helped with home office supplies.

- We have provided support for home schooling by finding resources that help.

- We have delivered locally on behalf of loved-ones far away who could not visit.

- We have kept local people in work.

If I was in charge, my website would answer the fundamental question of why … why a national newsagent week? The supplier focus on the hame page reflects on the parties driving the campaign.

I get that those leading the campaign feel passionate about it and may not like critical assessment. The thing is, this is not a 2020 relevant campaign. Nor is it a newsagency in 2020 relevant campaign. The website itself is old and tiresome in design.

I know that in the newsXpress newsagency marketing group, we have run a series of campaigns that shine a light on the value of the local newsXpress business. These have been personally and practically focussed, leading to beneficial local engagement.

All of the above aside, there is no harm in newsagents putting up the poster and supporting the campaign, as I expect plenty will.

Footnote: I’ve written about this today on behalf of several newsagents who have contacted me about the campaign. What I have written reflects their opinions.