On Insiders this morning on ABC TV, James Campbell from the Herald Sun worried with all his might that the Melbourne CBD may not come back. he went on to say the the CBD was the “engine room” of the Victorian economy.

The melodrama was laughable.

CBDs have been fading in relevance for years, before Covid. The shop local movement has had an impact. Federal and state government region al policies have had an impact.

Campbell’s comments re the CBD were ignorant, but on point for what we see from the Murdoch press.

The thing is, regional, rural and suburban high street shopping is better in Australia now than for decades. Shoppers are spoilt for local choice.

Shopping is easy and safe, too.

People like this. Local shoppers like it. Local shopkeepers like it. Local makers like it.

Local shopping is the engine room of retail in not only Victoria, but Australia.

But, if we are to believe Campbell, a strong Melbourne CBD is critical to economic success in Victoria. He needs to read more, and get out more. Melbourne CBD office workers who have been working from home and who have a choice to continue to work from home are more likely to choose to work from home … thereby transitioning Melbourne CBD shopping to local shopping.

I say this based on reporting recently on this very topic.

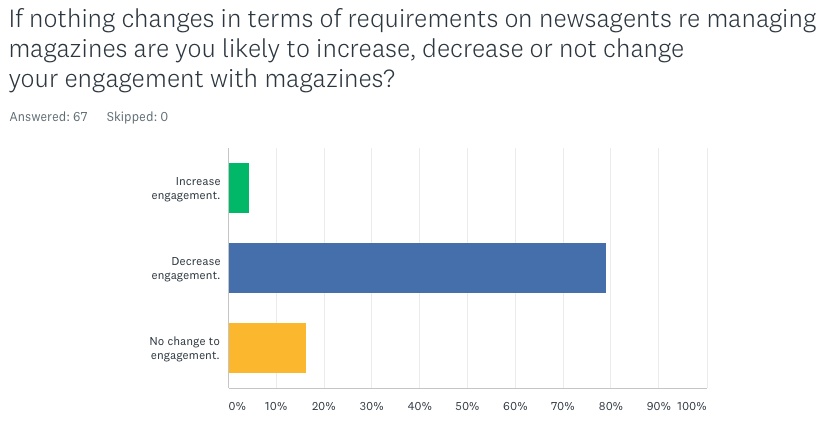

Most newsagents are in regional, rural and suburban high street situations. They are benefiting from people working, living and shopping locally. This is why many have had a good Covid and why many are having a terrific start to 2021.

It seems from what Campbell has said that he does not want that. It appears he would prefer the national chains in the Melbourne CBD to be doing better. Well, James Campbell, therein lies a problem. national chains, especially department stores, are a retail sector in trouble. Brands are going direct, cutting out the middle person department store.

For us, we need to keep doing what we have been doing – evolving our businesses in service of local shoppers with products sourced locally where possible, encouraging local makers and proving the circular value of local.

For me, I’ll ignore Campbell and his shouty pouty Murdoch colleagues. They are an ignorant and selfish lot. They do not serve Australia and Australians well when it comes to discourse on these topics.

I feel for retailers in the Melbourne CBD and all CBDs. However, the drift from big city shopping has been on for a while. This is not a new phenomenon.

There are many retailers who saw this years ago and adjusted their businesses accordingly. Those newsagents are doing well, which is great news. Sadly, we won’t see this as a news story as media outlets prefer the negative over the positive.