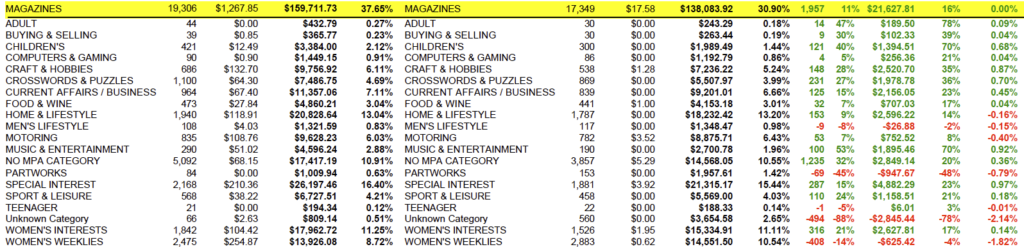

I was talking to a newsagent yesterday about their card situation. Their card sales are down 11.5% in 2022 so far compared to 2019 (pre Covid). They have seen me talk of double digit growth in newsagencies over the same period and wanted some advice.

They are half way through a contract with their card company. Because of the up-front money they received from the card company, it was called an advance on the projected rebate, they are locked in.

The problem for them is that the cards are not doing as well as projected in their newsagency. This means they are falling behind, which means the contract will likely need to be extended, unless they pay back the advance plus some costs associated with it.

They took the cash up front offer from the card company because they wanted extra working capital. It was pitched to them as an interest free loan and while it does not have a traditional interest component, the card performance has a cost that is, l in my opinion, higher than interest.

The cards this newsagency needs are card that perform well. That is not what they have, and they are locked in, which is distressing for them. Looking at their data at a pocket level, more than half the pockets are seriously under performing.

Newsagents beware.

The offer of cash up front for a long term contract may not be in your best interests, no matter how much you want / need that cash.

Of course there are some on the card supplier side who will talk the opportunity up and pitch it as a partnership designed to help you. What they want, the only thing they want, is a rooftop locked in. It’s what they sell you that matters and while they do want you to sell cards, having you locked in is even more important. Shock, horror: their interests are likely not aligned with yours.

There are many factors that determine card performance in a newsagency. Range is one. Newsagent engagement is another. Out of store marketing is another. Data based decisions is another. These decisions and engagements are best done on the basis of business and not because of a financial handcuff.

Back in 1996 when I bought my first newsagency I did accept card company money I return for a card supply agreement. Today, no matter the circumstances, I’d not agree to such an arrangement as I cannot see any benefit for the business.

The newsagent I spoke with on the weekend does have some avenues they can explore if they can prove that the agreement provided by the card company is holding their business back. Making their case in a small business claims forum would rely on their card sales data and them being able to show that it is worse than newsagents in similar socio-economic situation with cards from another supplier. If they were able to make that case, the agreement could be re-cast by the member hearing such a case, to make them more equitable for the newsagent. However, I suspect that the card company may agree to a resolution through mediation as they would not want the matter publicly aired.