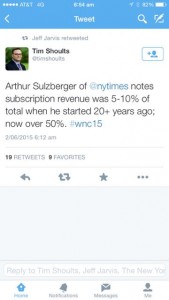

Over the counter magazine sales in the US and Canada were down 14.2% for the first quarter of 2015 compared to the same quarter a year earlier. While better than the 15.6 decline for the fourth quarter of 2014, the Q1 2015 decline is concerning.

I have taken results from a news release from Magnet an organisation formed by magazine wholesalers representing 99% of magazines sold.

If you read the release there is a claim that the sales decline is being driven by short supply. The release also documents challenges being faced by stakeholders including the reduction in retail space:

While there were some titles as well as entire publishing lines that had sales increases in the first quarter, overall the sales trend continues to decline. MagNet, like other interested industry participants, has continually recommended that the industry find a way to work together, with major publishers, distributors and wholesalers developing a strategic plan to engage retailers to again focus on our category. But currently, we see no signs that indicate this is happening. Instead, we see some retailers removing checkout pockets and reducing the size of mainline fixtures. Without a concerted effort by the major industry leaders to sell the overall value of our products to retailers, the loss of retailer real estate dedicated to magazines will continue as sales decline. Magazines at retail are an impulsive purchase. If consumers can’t find our product, they can’t purchase it.

This is happening in Australia too. Publishers and distributors need to understand the economics of retail and to fully understand the cost of each magazine pocket where the cost includes the space, services, labour and opportunity cost.

If the MPA was smart they would have undertaken this research before commencing testing new supply rules as I don’t think they understand why newsagents do what they do with magazines. There is bo point in testing a solution until this is understood. Key to achieving understanding is to be certain as to the costs points and what the costs actually are.

In the typical Australian newsagency today, magazines are primarily a destination purchase in my view. To maintain that space we need to range destination titles. If we had control over supply, smart newsagents would increase their range in pursuit of increased sales. Unfortunately, the paternalistic approach to magazine supply in our country is the key factor in driving magazine sales down.

But back to the North American results. While their situation is different, it is interesting to see suppliers being targeted for their role in the sales outcome.

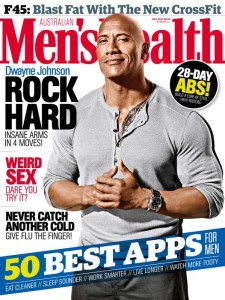

Dwayne The Rock Johnson is on the cover of the latest issue of Australian Men’s Health and we should promote the heck out of this issue because his latest movie, San Andreas is very popular at the box office and it was shot here in Australia. When I say promote, I mean in a way to connect with his fan base and the fans of the movie. For me, this means out of store promotion on social media and front of store promotion to attract passer-by traffic. It is the social media marketing I am most keen for as this is sure to get my business noticed by more people who are not aware of us.

Dwayne The Rock Johnson is on the cover of the latest issue of Australian Men’s Health and we should promote the heck out of this issue because his latest movie, San Andreas is very popular at the box office and it was shot here in Australia. When I say promote, I mean in a way to connect with his fan base and the fans of the movie. For me, this means out of store promotion on social media and front of store promotion to attract passer-by traffic. It is the social media marketing I am most keen for as this is sure to get my business noticed by more people who are not aware of us.