Pitching the Pacific Magazines promotion

We have supported the Pacific Magazines $65,000 promotion throughout the business – at the counter and in the magazine department with participating titles. While cutting through during Christmas is challenging because of the visual noise this season, we have tried to keep space around the signs less noisy – so the promotion is noticed.

We have supported the Pacific Magazines $65,000 promotion throughout the business – at the counter and in the magazine department with participating titles. While cutting through during Christmas is challenging because of the visual noise this season, we have tried to keep space around the signs less noisy – so the promotion is noticed.

Myer leverages the counter

Myer in Melbourne is pitching Nutella at the counter in their bedroom furnishings department. If ever there was a time for retailers to be bold in counter impulse item selections then this is it. Here is Myer pitching something sold on a different floor in their sprawling store. Never promote at the counter what people expect.

Myer in Melbourne is pitching Nutella at the counter in their bedroom furnishings department. If ever there was a time for retailers to be bold in counter impulse item selections then this is it. Here is Myer pitching something sold on a different floor in their sprawling store. Never promote at the counter what people expect.

Boosting early Christmas season engagement

In the US, Black Friday, always the Friday after Thanksgiving, is huge for retailers. It goes from the Friday through the weekend. Then there is Cyber Monday, the Monday right after.

In the US, Black Friday, always the Friday after Thanksgiving, is huge for retailers. It goes from the Friday through the weekend. Then there is Cyber Monday, the Monday right after.

The US Black Friday ‘season’ is now entrenched in the UK. But it is yet to gain traction here. We do have an online sale but it’s not big.

I am interested in Black Friday as it is massive in the UK, a place to where the season migrated.

The idea of boosting seasonal sales ahead of when you might traditionally discount for a season is interesting. It is something we have tried a couple of times this year, discounting for one day only quite early in the season. The goal was to gain a buzz, and it did. This worked for a specific location where more than a third of shoppers are not regular, not local. I think that is the key.

Retail today demands thinks be changed up. This is why I think it is important we talk about a different approach to when we use a discount as a promotional mechanism.

We did a one-day Christmas sale early this month. It was a terrific boost. It was not a Black Friday event and I am not proposing this here.

In the UK ten days ago I was surprised at the extent of Black Friday. Here is a gallery of window signs, demonstrating the extent of retailer engagement in the season. I took all these photos in a short period the Saturday and Sunday following Black Friday.

Branding separate from the traditional newsagency shingle

newsXpress has gently launched #NOTANEWSAGENT, the next step in building focus for the newsXpress as distinct from the newsagency channel.

A brand is only seen as a brand if you promoting it as such. Promotion starts with explaining what the brand stands for. That is what the first communication piece, an in-house produced video, is all about. Here is the video launched yesterday:

Branding away from the term newsagent or newsagency is important for several reasons:

- Major brands no longer lend against the value of a newsagency business.

- Major landlords no longer permit newsagency businesses, instead preferring branded more current businesses.

- The ATO benchmark for a retail newsagency business is out of date and not relevant to a transforming business.

- Some suppliers will not supply newsagency businesses.

- Some traditional newsagency suppliers no longer recognise the newsagency channel as a distinct channel.

The #NOTANEWSAGENT move is not intended to disrespect newsagents or newsagency suppliers. Rather, in addition to serving the needs of newsXpress members, it seeks to open consideration by others as to the role of the old-school shingle. It is part of a considered and researched strategic plan.

Magazines, stationery, newspapers and other core categories remain important. However, new traffic is coming from other categories and that is vital to the health of the business in the future.

The recent newsXpress branded Tv commercial delivered excellent new traffic to newsXpress businesses. They sought out that brand and not the generic shingle. This is important in a competitive retail environment.

We see change all around us in our ‘newsagency’ businesses. While we can react to change, we are better off leaning in, better off chasing change, so we are ahead of the curve.

There is no end-game here. Change is the new normal in retail, in newsagency retail especially.

There will be some who criticise the #NOTANEWSAGENT positioning. They are entitled to their view. I am reminded of those who criticise me in 2010 for my prediction then of where magazine and newspaper sales would be today. Unfortunately, I was right. Those who acted in 2010 are better off today than those who did not.

Regardless of what the channel is (or channels are) called, I hope for a strong future for all businesses that identify themselves as newsagencies today. The strength of the future depends on your commitment to change today.

My personal hope is that #NOTANEWSAGENT gets newsagents thinking about the positioning of their businesses in the context of print media disruption, retail disruption and changes in economic conditions. Thinking alone is a start.

More on the changes in the GP mix in Australian newsagencies

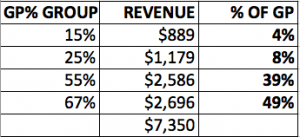

Further to my post Friday last week on Changes in the GP% mix in newsagency businesses, I share here analysis I do by GP group. I group products sold in my newsagencies by GP group. Note, these businesses do not have lotteries, tobacco or the usual agency product.

This analysis is for one day last week.

Reading across the table, next to each GP band label is the revenue for that band and the percentage of total GP earned by the products in that band.

Reading across the table, next to each GP band label is the revenue for that band and the percentage of total GP earned by the products in that band.

I find the table useful as it focusses attention on where the business makes its money.

Too often newsagents get caught up with the volume of low margin product. Too often they seek the business of low margin product. yet is is the high margin product that is undoubtedly the most valuable to the business. This very simple spreadsheet reflects that.

Our gross profit mix is changing and has to change more. With rent increasing 5% year on year and labour costs increasing 3% and more each year, the business has to make more. These challenges alone are sufficient to drive us to pursue more efficient products. Efficiency to me is good GP products, higher end, turning at a sufficiently healthy rate to generate the growth in return for the business that is necessary to be able to stay ahead of the overhead increases.

I don’t do this analysis every day, week or even month. It is like taking a temperature reading. I do it quarterly or thereabouts, to ensure the business is sitting where I expect and at least where it needs to be.

Where there is all sorts of analysis one could do, I have found this simple spreadsheet useful in tracking the transition of the business because forward movement on transition is crucial to what we need to see in our businesses.

This GP band analysis can be done in any type of retail business as GP% is GP%, it does not require an analysis or understanding of specific products.

Change is the key here. We have to chase it every day because if we keep doing what we are doing we will only ever see the results we have seen and for many retailers that is not good.

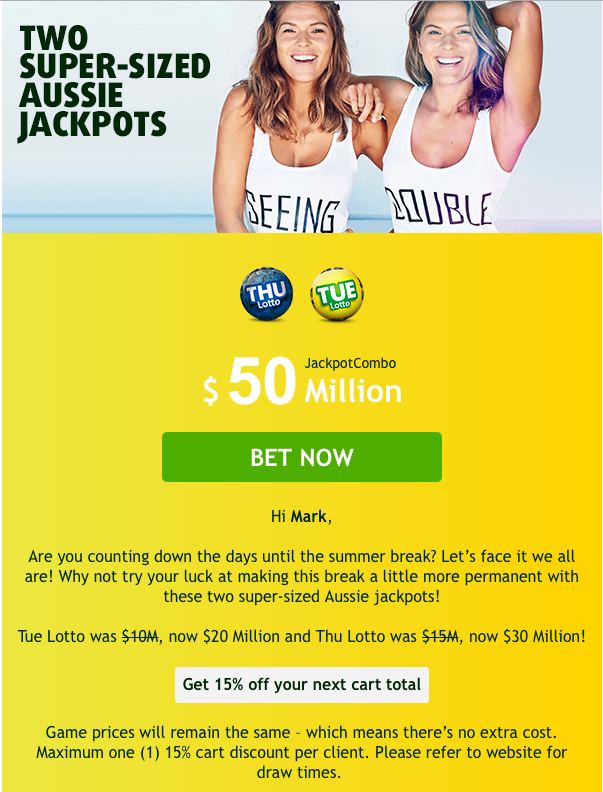

Lottery marketing tactics in the spotlight in QLD

The Courier Mail yesterday had this story about concerns regarding free betting offered as part of marketing. This story appears to be a result of agitation by Tatts on the issue – if you read the article.

The Courier Mail yesterday had this story about concerns regarding free betting offered as part of marketing. This story appears to be a result of agitation by Tatts on the issue – if you read the article.

Lottoland offers free betting as part of its promotional activity too so I suspect they would be in Tatts’ sight on this issue.

This issue should be of interest to newsagents as the migration of gambling dollars away fro traditional and more regulated gambling is serious.

Sunday newsagent marketing tip: setting the shop for Christmas

Here is the front section of one of my newsagencies, as at yesterday – showing how it has been set to maximise traffic at the front of the business.

Sunday newsagency management tip: manage rep orders

If you allow representatives of supplier businesses to place orders for your business, ensure you have an agreed step in the process whereby orders are not to be placed unless you expressly approve other. Otherwise, you may receive stock you don;t want, stock supplied to serve your supplier more than your business.

Sunday newsagency challenge: raise your bar

Whatever you think is the most expensive gift item you can sell, find a range worth double your top price point that you think could sell and stock it. The challenge is to find a new high point you can achieve for what you could sell.

Do you send Christmas cards?

Talking with a newsagent yesterday they commented they never send Christmas cards, can’t see the point. This was in a discussion about business performance including discussion about falling card sales.

We need to help Australians understand the value of cards. One way we can do this is by personally engaging with the category ourselves, personally. Hence my question about sending Christmas cards.

We ought to show people the value of cards by sending them. Not only at Christmas time but at other times through the year, especially for non traditional occasions – to help Aussie understand how valued receiving a card can be.

Given card sales nationally and in our channel, this should be mission critical for us. It is up to us to pitch cards as an ideal way for expressing ourselves. Christmas is a terrific season for doing this.

Changes in the GP% mix in newsagency businesses

I have been asked twice in the last month for basket analysis data for different types of newsagencies, to look at how they compare specifically in the percentage mix of products sold – using the basket and other data I have from the newsagency benchmark studies I do.

In each case, the request came from a party undertaking research into the current performance of the newsagency channel, to feed into projections they were developing to plot an expected future of the different types of newsagency businesses.

In my own analysis I group retail newsagencies in to three types. Here is one table of the top level analysis I shared on these three types of businesses:

The purpose of this table is to show the difference in revenue contribution across key product categories for each of the three groupings of newsagency businesses as I see them.

While these groupings of mine are arbitrary, I have developed them after years of work in this area, looking at data from many newsagencies.

The results are what is happening, not what might happen but what is happening.

The traditional newsagency is the old-school business, the one reliant on papers, magazines, stationery, cards and tobacco. Oh, and probably lotteries in there too. However I did not include lotteries in this table as it is not relevant to the physical product based retail assessment I was looking at.

The transitioning newsagency is the one playing outside of what has been traditional. You will see a reasonable gift department and a retail focus more on seeking out new customers.

The advanced transitioning ‘newsagency’ is a business relying on non traditional newsagency lines for key traffic and selling traditional newsagency lines as the add on. There are not significant numbers of retail businesses in this group, yet. However, this group is rapidly growing.

This table surprises some suppliers, especially old-school newsagency suppliers as their model relies on the traditional and they wonder how to connect with those businesses that have eft the traditional model.

There is now doubt the newsagency channel is undergoing extraordinary change at a rapid pace. The purpose of this post is to share publicly there difference in terms of revenue breakdown percentages between the three broad groups as I define them in the hope it encourages newsagents to see where they sit and to consider further changes they can make.

Change is our friend. We need to embrace it in every part of our businesses, urgently.

Brilliant teachers gifts

These teachers gifts that I saw at newsXpress Emerald in Queensland Tuesday show what a bit of thought can create – perfect gifts that will not break the bank and that give a laugh.

These teachers gifts that I saw at newsXpress Emerald in Queensland Tuesday show what a bit of thought can create – perfect gifts that will not break the bank and that give a laugh.

Retailers often seek out exclusive products from suppliers. Smart retailers make them for themselves.

I love this product idea.

Kudos to newsXpress Emerald.

Sanity competing in the calendar space

I noticed the calendar pitching a Sanity store in Emerald in Queensland – two calendars for $20.00, a 20% discount off the suggested retail price. While the multi-buy offer is compelling, that it was placed in the back corner of the shop without any supporting collateral left it to be an offer for those who shop the shop rather than driving traffic from front of store placement.

I noticed the calendar pitching a Sanity store in Emerald in Queensland – two calendars for $20.00, a 20% discount off the suggested retail price. While the multi-buy offer is compelling, that it was placed in the back corner of the shop without any supporting collateral left it to be an offer for those who shop the shop rather than driving traffic from front of store placement.

A warning to newsagents in the News Corp redundancies

The news of redundancies at News Corp. are something for newsagents to consider as they come on the back of an 11% decline in ad revenue in the first quarter of the company’s new reporting year.

The 11% decline in ad revenue matters to newsagents as this is a key figure in determining the value of putting the print product into the marketplace.

Worldwide, ad revenue in print newspapers is down, plummeting according to The Wall Street Journal – they say the global decline is expected to be 8.7% this year.

All of the gloomy data points in these stories and the year on year trajectory of the data points about newspapers tell us that print newspapers will end. The trends are too well established, habits have been changed forever.

Any newsagency business owner relying on newspapers for traffic needs to be fully aware of what is happening on newspapers. They need to factor the reality of the trend into their business plans. They need to know (or should have known more than a year ago) what the business needs to replace the traffic of newspapers.

Take the news of the redundancies this week as a prod to engage on the issue of replacing the newspaper traffic. Ensure you have a plan, and start implementing it. Many have already and for many of them it is going well.

Gotch helps newsagents ensure they have the top titles

I love the list from Gotch yesterday listing the top 50 titles. This is a good first step. Next, I would love the list to be accessible online, by MPA category and segment. Then, I’d like the ability to click to easily order a title. This is how we can expand range and help sell more magazines, especially magazines in the long tail – niche titles that often get lost in the mix. This is what many newsagents want – an easy way to specialise without the risk of a pandora’s box being opened and unwanted titles being sent.

I love the list from Gotch yesterday listing the top 50 titles. This is a good first step. Next, I would love the list to be accessible online, by MPA category and segment. Then, I’d like the ability to click to easily order a title. This is how we can expand range and help sell more magazines, especially magazines in the long tail – niche titles that often get lost in the mix. This is what many newsagents want – an easy way to specialise without the risk of a pandora’s box being opened and unwanted titles being sent.

Elf on the Shelf sales flat?

I have seen the Elf on the Shelf product discounted by as much a 30%, which is odd as this item sold well last year through until the week before Christmas. This year, in shops and online, I am seeing it discounted. This makes me wonder if the route to market change for this year has not worked as expected.

The retailers where I have seen Elf on the Shelf discounted have been more larger businesses where stock is given little time to perform before it is quit.