There are some retail business consultants pitching their services and ideas to newsagents and others in our channel.

My advice is to beware, approach with caution, question the suggestions and advice from business consultants and self-proclaimed retail experts. Ask for evidence that supports their suggestions. Seek our references from indie retailers who have benefited from their advice. Ask the basis on which they make suggestions. Most of all, ensure they understand the channel and what is being confronted.

What newsagency businesses is experience is unique. It goes beyond ‘traditional’ disruption. There are multiple factors at plays, each impacting the other and the whole picture resulted is what I think is best describes as super-disruption.

I say super-disruption because we hear plenty about super-storms, super-cyclones and the like. They are bigger, more ferocious, more confronting versions of the singular. That is what we are dealing with, disruption on a level not often seen elsewhere.

I have heard from consultants working with newsagents and read some of their suggestions. While their ideas are okay, they do not consider the bigger picture, they do not deal with more of what newsagents are confronting. This is why I say about consultants and advisors…

My advice is to beware, approach with caution, question the suggestions and advice from business consultants and self-proclaimed retail experts. Ask for evidence that supports their suggestions. Seek our references from indie retailers who have benefited from their advice. Ask the basis on which they make suggestions. Most of all, ensure they understand the channel and what is being confronted.

Some of the disruptors playing into each there in our channel include:

- The decline of print media.

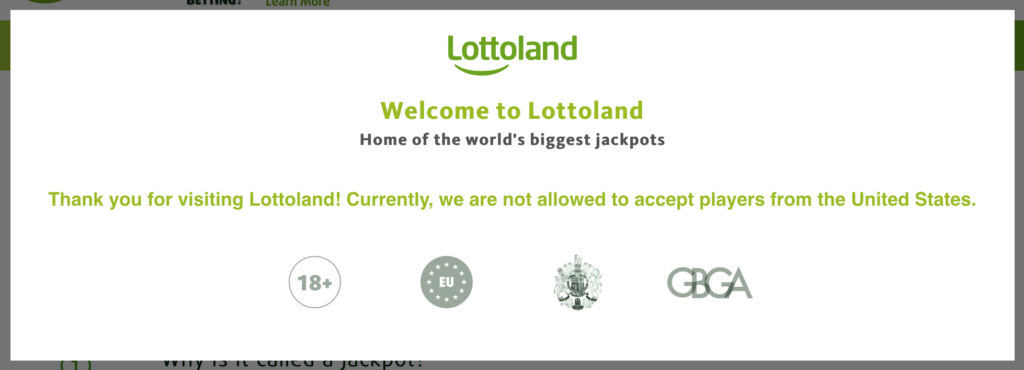

- Migration of lottery purchases online.

- The decline in physical stationery use.

- Migration of the stationery shopper to online and big business.

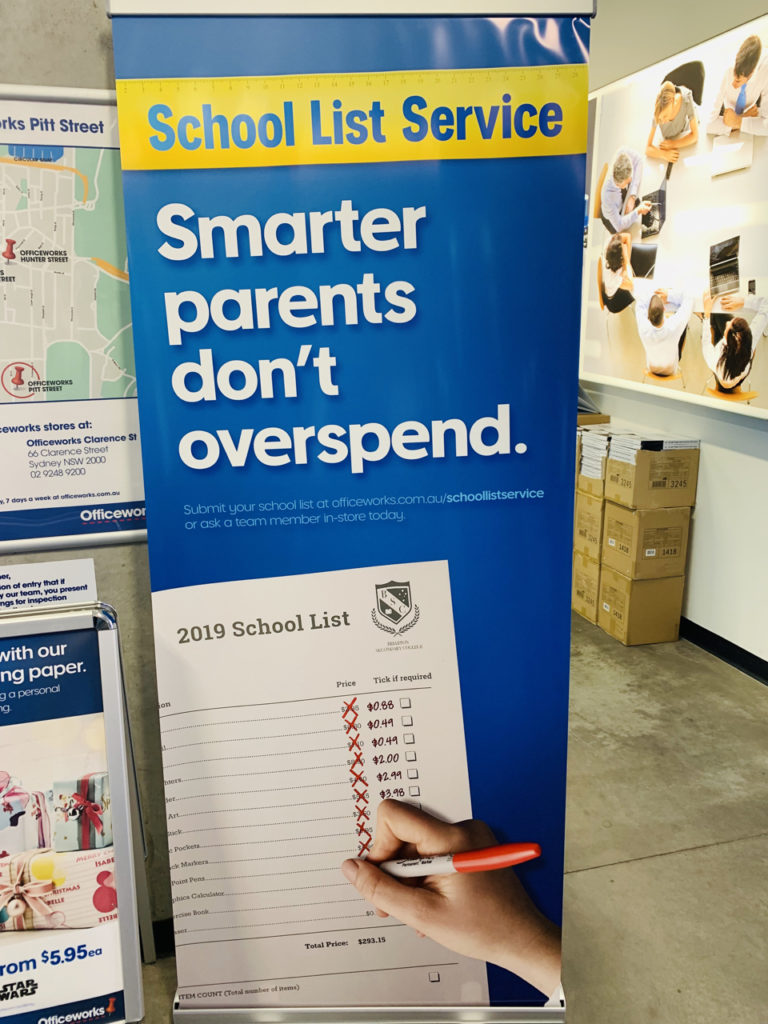

- Migration of local school stationery business to online and big overseas businesses.

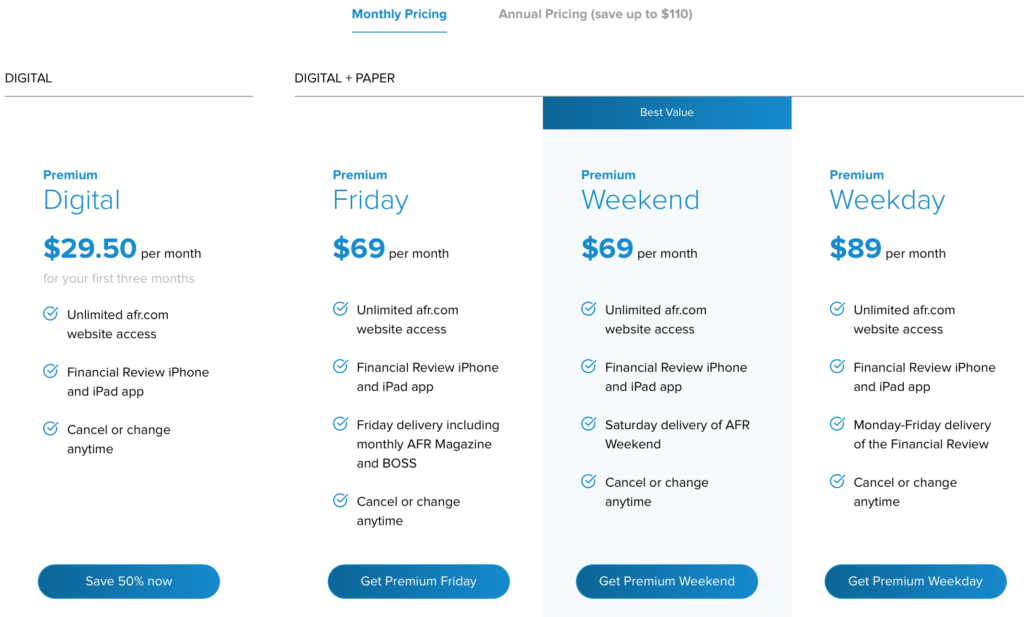

- Growth in corporate convenience businesses.

- Migration of transport ticket top-up to online.

- The closure of many newsagencies and the resulting impact on channel suppliers.

I don’t see these disruptors as problematic … if you engaged early and transitioned your business. The opportunities for change and growth in a ‘newsagency’ business remain considerable.

My key concern about the consultants and retail experts who are plying their trade in our channel is for those yet to transition, those keen for advice and guidance. Unless the consultants and retail-experts do thorough homework, I fear their advice will be of little real value.

Like anything, buyer beware.

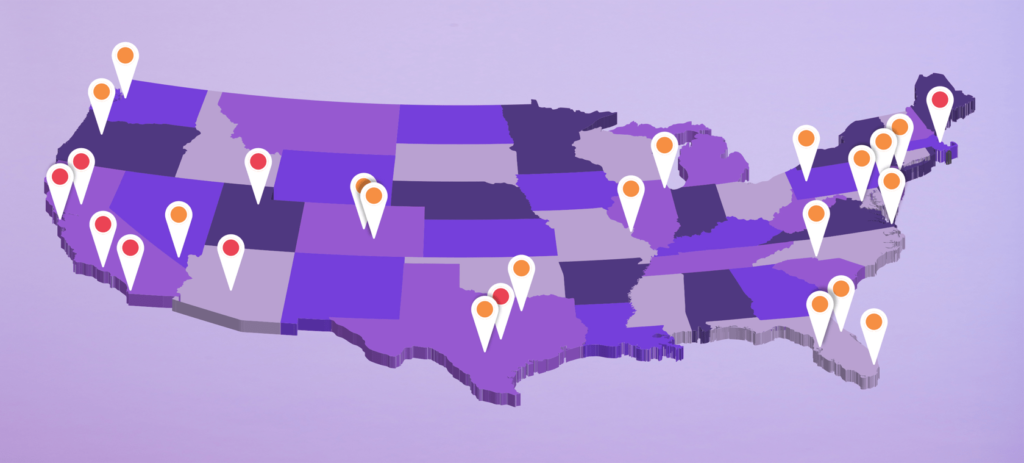

7-Eleven offers a delivery service in the US. The products are not just convenience lines such as drinks, donuts, bananas, candy and similar. No, the range includes frozen food, stationery, gadgets, personal care, health and more categories. The range is quite broad.

7-Eleven offers a delivery service in the US. The products are not just convenience lines such as drinks, donuts, bananas, candy and similar. No, the range includes frozen food, stationery, gadgets, personal care, health and more categories. The range is quite broad.