Product manufacture and shipping hit several newsagency suppliers

New Covid outbreaks in China are impacting product production. Container shortages are impacting shipping. A shortage of capacity on ships is impacting shipping. Port capacity challenges are impacting shipping.

All in all, many suppliers sourcing from China are confronting significant delays. Unfortunately, not all suppliers impacted are being as transparent as they could be.

The Nine Media papers covered this in a story published online yesterday:

‘String of disasters’: China’s shipping delays set to widen trade chaos

The global shipping industry, already exhausted by pandemic shocks that are adding to inflation pressures and delivery delays, faces the biggest test of its stamina yet.When one of China’s busiest ports announced it wouldn’t accept new export containers in late-May because of a Covid-19 outbreak, it was supposed to be up and running again in a few days. But as the partial shutdown drags on, it’s further snarling trade routes and lifting record freight prices even higher.

Yantian Port now says it will be back to normal by the end of June, but just as it took several weeks for ship schedules and supply chains to recover from the vessel blocking the Suez Canal in March, it may take months for the cargo backlog in southern China to clear while the fallout ripples to ports worldwide.

The port problems are expected to continue for another 6 to 8 weeks, which could play into Christmas plans.

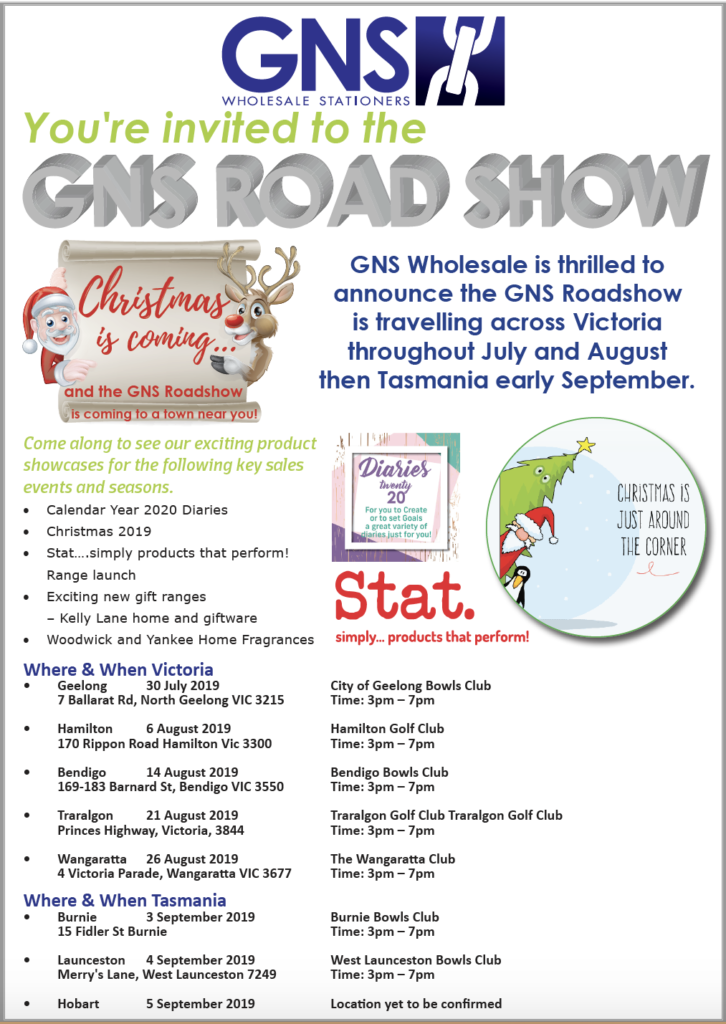

GNS most recently wrote about Chins sourced supply yesterday:

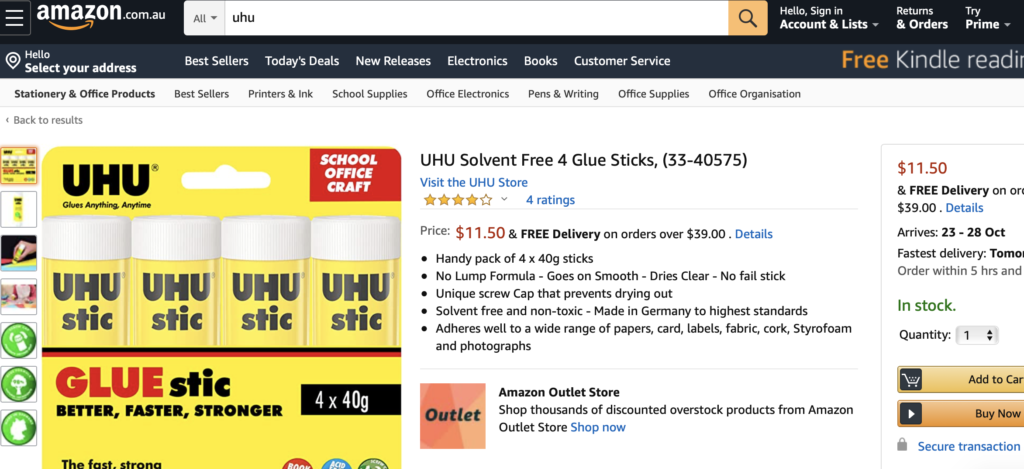

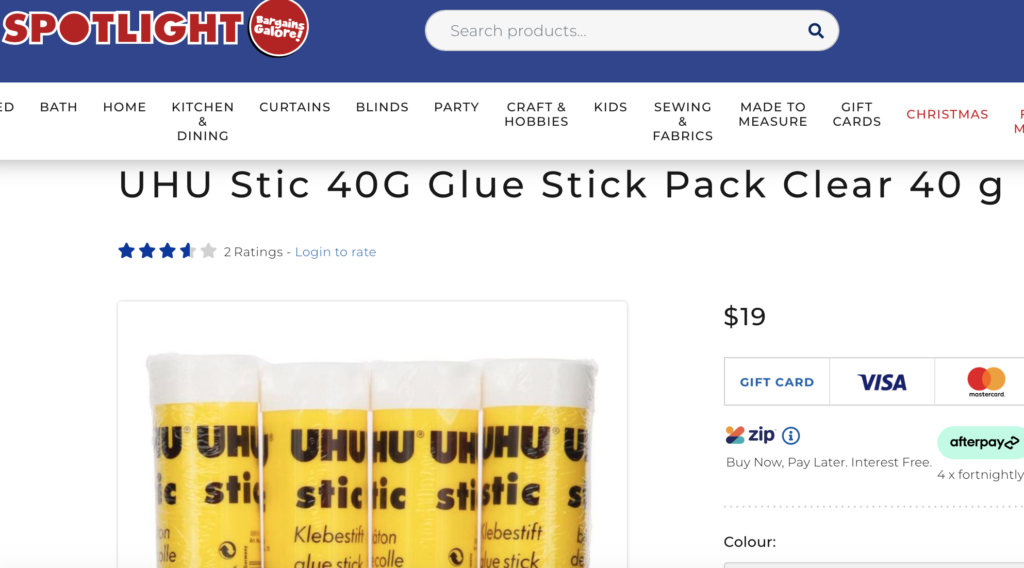

Increasing congestion across shipping ports in southern China is worsening due to a recent outbreak of COVID-19 cases. The Guangdong province, which is a key manufacturing and exporting hub in southern China, is experiencing its biggest backlog since at least 2019. As a result, we are facing ongoing challenges from our overall supplier base with stock availability due to Global manufacturing constraints, continued freighting challenges and pressures on raw material availability. We are seeing an increase in the length of supplier lead times of up to six months in some cases.

Rest assured, GNS is working closely with our suppliers to improve forecasts and stock availability. Our suppliers in some instances are airfreighting stock where they can to help ease the pressure, however we will still continue to have ongoing out of stocks impacting immediate stock availability.

If you require any updates please do not hesitate to contact your GNS Sales representative or your local GNS Customer Service team.

Good for them for being transparent.

GNS is not alone in experiencing an impact.

If you are a supplier and have been impacted or expect to be impacted, please let retailers know now.