The lobbying on payments equity for small business retailers continues

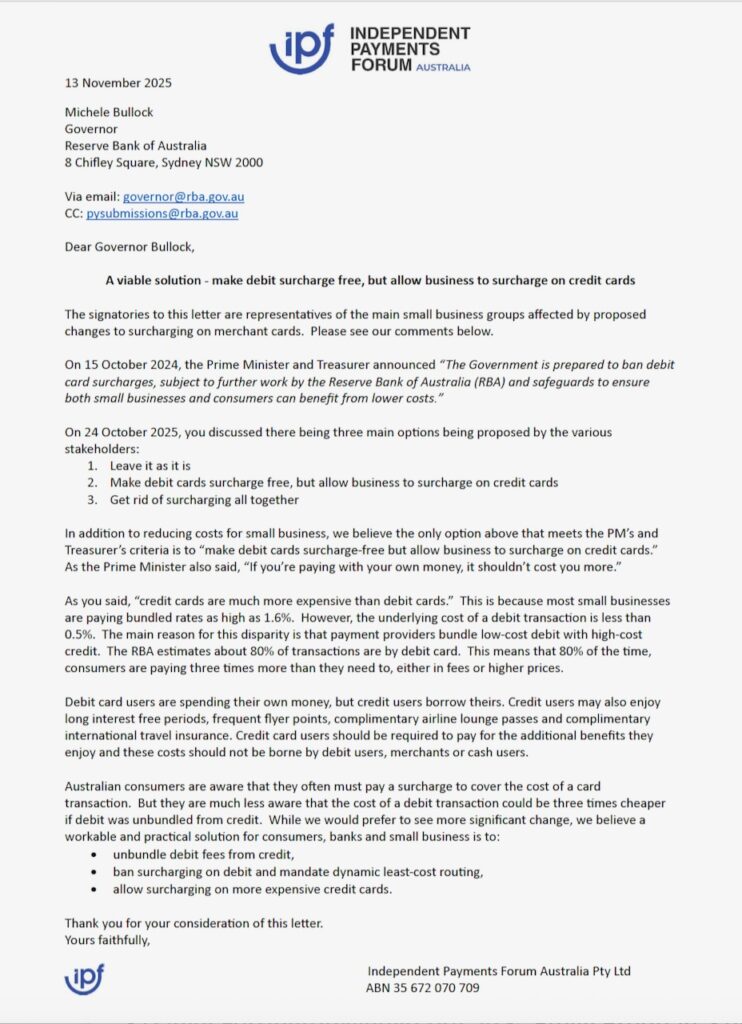

The Independent Payments Forum, a lobby organisation representing many small business groups including ALNA members and newsXpress members from our channel, continues to lobby for more equitable payments arrangements.

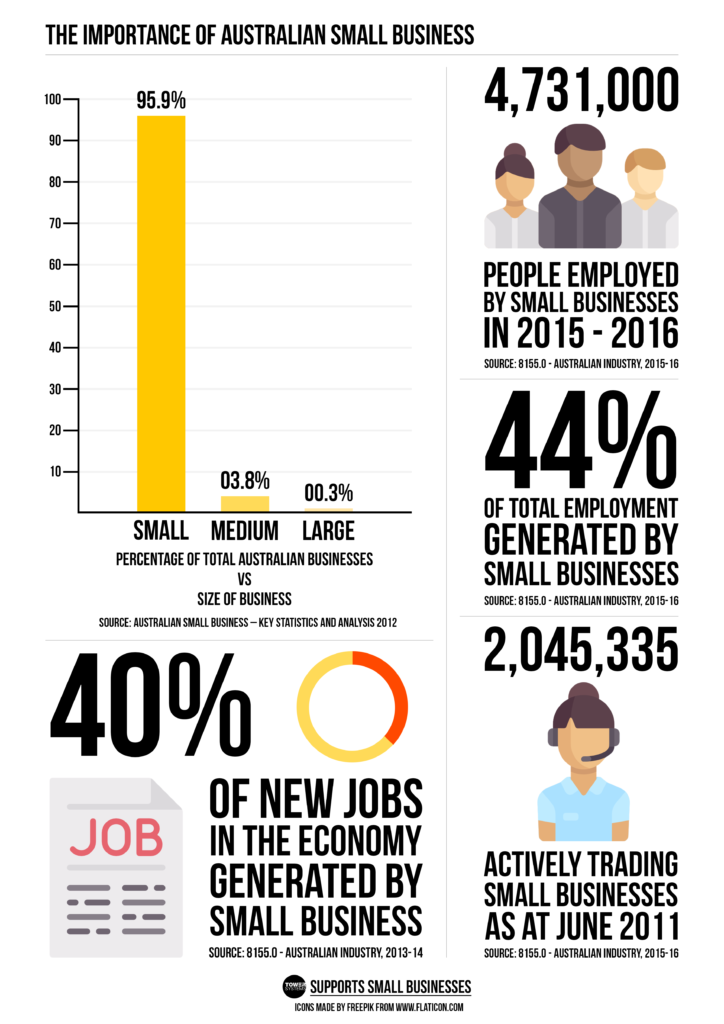

The core issue being dealt with here is that payment providers “bundle” low-cost debit card fees with high-cost credit card fees

- The high cost: Many of us are stuck paying a single bundled rate as high as 1.6% for all card transactions.

- The reality: The actual cost of a debit transaction is tiny—less than 0.5%.

- The imbalance: The RBA estimates about 80% of transactions are now by debit card.

This means that for 8 out of 10 sales, we (and our customers) are paying a fee that is more than three times higher than it should be.

The current situation places an unfair burden on small businesses for the profit of the banks, because those in power for decades have not cared enough to support fairness for small businesses. We either matter to them, or not.

Here is their latest letter to the IPF, which had my signature presenting newsXpress members.

The letter to the RBA supports the government’s idea of making debit surcharge-free, but only if it’s done correctly. Banning all surcharges (Option 3) would be disastrous, forcing us to absorb all credit card costs or raise our prices for everyone

Small business retailers, like newsagents, are dealt with poorly by banks, the RBA, payments companies and politicians in this area. It is only continued lobbying, like the work of the IPF, that offers any hope of an outcome that’s reasonable for us.

This proposal by the IPF is a win-win if adopted by those in control.

- For our customers: The 80% of customers who use debit cards get a surcharge-free transaction, as they should.

- For our business: We stop losing margin by subsidising expensive credit cards. We finally get to pay the true low cost for debit and can fairly pass on the true cost for credit.

This proposal from the IPF is the only option that fixes the root cause of the problem. It brings fairness and transparency to a system that has been costing us—and our customers—too much for far too long.

What the IPF is proposing here is our best chance to fix a system that has been unfair to small businesses and our customers for too long. By standing with and supporting the IPS on this, we are pushing for a common-sense change. This solution allows us to finally offer our debit-using customers the surcharge-free experience they deserve, while ensuring our businesses aren’t left to pay for expensive credit card reward programs. It’s the only option that brings true fairness and transparency to our counters.

It does surprise me that other groups that claim to represent newsagents are not supporting the IPF.

…

Mark Fletcher founded newsagency software company Tower Systems and is the CEO of newsXpress, a marketing group serving innovative newsagents keen to evolve their businesses for a bright future. You can reach him on mark@newsxpress.com.au or 0418 321 338.