The Council of Small Business Organisations of Australia, of which ALNA is an active member, is lobbying on behalf of small business retailers. Here is their complete release on this, a release that draws on an earlier release from ALNA:

The big landlord problem is now obvious for all to see – small businesses need intervention

COSBOA calls upon the biggest landlords in Australia to set an example of responsible behaviour in a time of crisis, and to start acting in good faith with the proposed Mandatory Commercial Tenancy Code (“the Code”). Some landlords are doing the right thing, but many, including the largest ones, are still unwilling to share the financial impact of social distancing.

Peter Strong, CEO of COSBOA, stated “The COVID-19 issues for small business are many, as they are for everyone. We recognise that thanks to strong leadership, federal and state/territory governments have flattened the COVID-19 curve. A consequence of this, however, has been an extraordinary drop in our retail foot traffic. This is not the fault of tenants or their landlords, but one of the most pressing issues is getting landlords to engage genuinely and effectively with their small business tenants to fairly relieve their rent burden when they have few or no customers. As we work hard on the other big issue, employment, through the JobKeeper program, we have to also deal with the immediate challenge around rent and retail leasing. A business cannot use JobKeeper if it is bankrupted, or will be, by a landlord.”

COSBOA sees the best solution now is for the states to legislate that all retail tenants who are eligible under The Code and who are the most vulnerable, like businesses with less than $2 million turnover, have an immediate three-month waiver for April to June on rent, with support from government to share this cost with landlords.

This will clear the decks with immediate support and we won’t lose businesses unnecessarily. It can be followed by good faith negotiations under the code. Mediation can occur if it is required, as is the intent of the Code.

Mr Strong added “the fact is that payment of rent is not possible for a large proportion of small businesses in malls and the current behaviour of the landlords will create tens of thousands of bankrupt businesses. The development of the JobKeeper program would be meaningless if a business was bankrupt and the owner of the business was in deep despair. However, landlords overwhelmingly seem to fail to understand we are in a crisis.”

COSBOA understands this is not a federal issue as the states are responsible for legislating the leasing regulations required for the proposed Code now.

Mr Strong also added “we see the West Australian Government have led the way with yesterday’s announcement of $100 million in land tax relief grants available for commercial landlords who waive rent for 3-months for small business tenants who have suffered a 30 per cent drop in turnover due to the impact of COVID-19.

Where the federal government can help is to bring forward changes to sensibly increase the thresholds for Unfair Contract Terms (UCT). This will provide fairness for small business tenants from aggressive contracts and leases. It must be acknowledged that the Prime Minister and the Treasurer have confronted this problem, and they have probably discovered what we in small business have known for decades: that the biggest landlords are not the most constructive, contributing members of our society.”

Many businesses need outcomes now or at least in the next few weeks, not the next few months. Unfortunately, we do not see this happening. There is also the recent intervention of the ACCC which has given many landlords the ability to share information about their tenants. This has provided those landlords the opportunity to legally connive and then take similar ‘actions’ with tenants. These landlords appear to be using the authorisation and The Code (even though it is not legislated yet) to co-ordinate and provide a protective mechanism for themselves while complicating and deferring outcomes for tenants.

Some of these landlords are asking for extensive information from tenants far in excess of what is required under The Code. This includes in many cases requests for P&Ls and balance sheets, not just disclosure of revenue impacts. They are also asking the retailer to demonstrate they have used all state and federal small business support packages first as well as bank assistance before they will consider any request. The landlords are creating significant additional and needless expenses for their tenants. These requests are time consuming, delay outcomes and require information which they really have no right to require (other than revenue impacts), and are not consistent with The Code or acting in good faith.

Mr Strong further added, “Bizarrely, some of the biggest landlords are asking tenants to predict their turnover for the next twelve months. This shows the landlords are not capable of forward planning yet expect small business people to do that planning for them. The federal government has deferred its own budget until November as it knows it cannot yet predict the future with any certainty, but the landlords expect small business people, under extreme personal stress, to produce a plan for the next twelve months. It is obvious that the authorisation landlords have been given by the ACCC should now be rescinded, and they must stop opportunistically asking for information that they do not need and that may harm these tenants in the long run.”

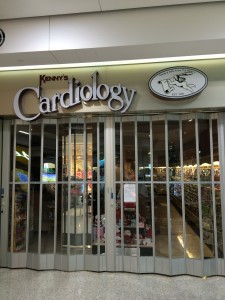

Note: The business folk and the employees who will be affected come from cafes, restaurants, newsagents, shoe stores, clothing shops, lottery agents and hairdressers among others and they need government help and good faith from their landlords to address this.