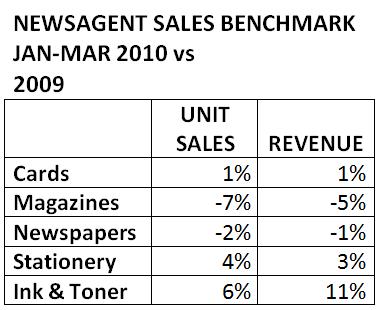

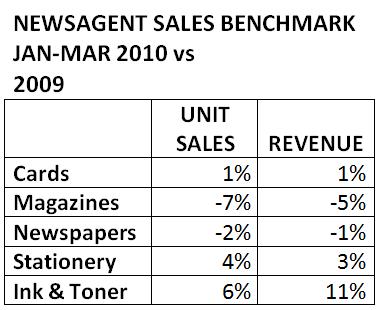

Retail sales, led by magazines, were down in newsagencies in January through March 2010 compared with the same period last year on a same-store basis according to the latest Tower Systems sales benchmark study. Magazine unit sales fell, on average, 7% over the same period.

Retail sales, led by magazines, were down in newsagencies in January through March 2010 compared with the same period last year on a same-store basis according to the latest Tower Systems sales benchmark study. Magazine unit sales fell, on average, 7% over the same period.

The key newsagent departments of magazines and newspapers are reporting concerning declines – especially on the back of declines in 2009 over 2008.

What differentiates this study over those from late 2009 and January 2010 is that green shoots are more evident – more newsagencies are showing growth, the difference between those performing well and those performing poorly is greater. For example, there were plenty of participating newsagencies reporting sales growth with magazines. These were pulled down by stores reporting double-digit declines.

Thinking about magazines for a moment, what is it that differentiates those stores showing growth or even 0% change and those showing double-digit decline. Once you take out stores growing or declining for one-off local factors such as construction or severe weather as well as stores more heavily affected by changes in magazine sales patterns (the decline in partworks for example) the difference can be put down to engagement.

The sales benchmark study, another in a series of sales performance studies in newsagencies for many years by Tower Systems, relies on data from a pool of 135 newsagencies using the Tower Systems Point of Sale software.

Looking at magazine categories, weeklies have had a challenging quarter – leading the decline in stores reporting a decline and showing only modest growth in the stores reporting growth. The categories showing the most significant growth are food, cars and special interest.

Newsagencies showing growth are more likely to have the owner or the most senior manager personally involved in magazines, making strategic and opportunistic decisions. These stores are also more likely to be engaged in external marketing which is designed to drive traffic.

The days of newsagents relying on their point of difference to pull traffic are over because our point of difference is no longer obvious.

External marketing around a compelling offer is crucial. This is where the ink result is interesting. Stores showing double digit growth are all running external marketing through flyers or ads in local newspapers.

As previous studies have shown, newsagencies in rural and regional situations fared better than their city counterparts. Shoppers visit less frequently but spend more in each visit – driving sales efficiency.

Outside of the categories noted in the table on the previous page, gifts, social stationery, lotteries and services such as photocopying all performed well.

Within the newspaper department, foreign newspapers continue to buck the trend, reporting unit sales growth of 4% for the quarter compared with 2009. Foreign language newspapers are vitally important traffic drivers and newsagent support is respected with customer loyalty.

The story inside the stationery department is interesting. The shift first noted in the January study is more consistent in this study. The data shows that newsagencies are shopped for convenience items. This indicates a convenience pricing model opportunity – better margin.

OPPORTUNITY

After spending several days buried in sales and other data from participating stores, I am reminded that it is important for newsagents, the business owners, to:

- Personally engage in the traffic driver departments: magazines, newspapers, cards and lotteries.

- Personally engage in the highest margin departments: cards, books and gifts.

- Work the counter as an opportunity for impulse purchases and not as a magnet for junk.

- Drive change, always looking for new opportunities.

- Keep focused on what the business stands for – make it obvious to passers-by.

It is easy for newsagents to lose their way. The nature of the work, the relentless arrival of new stock, the demands of suppliers and the long hours can make us less attentive to our businesses than we should be.

This document is a summary of the sales benchmark study data available. Participating stores wanting a more personal review of their business to the overall benchmark group are welcome to request this.

Click here for a print ready copy of the newsagency sales benchmark report.

Tower Systems undertakes this benchmark study as a service to help newsagents. It pulls the participating group from its community of 1,600 newsagents. Benchmark study details: 141 newsagencies submitted sales data for this benchmark study. This was culled to 110 by eliminating businesses with questionable data quality – usually where some items sold are not scanned. The comparisons are on a same store year on year basis. This makes the result more useful.