Newsagency sales benchmark results: Jan 1, 2024 – June 30, 2024 vs Jan 1, 2023 – June 30, 2023

I am grateful to the 121 newsagents trading under a variety of shingles in rural, regional and suburban settings who provided data for this study. The only connection is that they use newsagency software from my POS software company.

Challenging start to 2024 for many newsagents.

The first six months of 2024 have been tough for the many newsagents. It has been especially tough for those who have not transitioned their businesses to rely less on core product categories like papers, magazines and lotteries.

Before I share the averages for the channel, here are results for the top 5 businesses in the benchmark data pool. This small group is made up of regional and suburban businesses. Three of these do not have lotteries, which I think is a factor in the management focus.

- Revenue: Up by 12%.

- Sales transaction count: Up 2%.

- Basket value: Up 10%. This represents a shift in what people are buying.

- Items per basket: Up 7%.

- Average item value: Up 4%.

- Greeting card revenue: Up 7%.

- Magazines unit sales: Down 13%.

- Newspaper unit sales: Down 9%.

- Toy (incl. plush) revenue: Up 12%.

- Gift revenue: Up 22%.

- Homewares: Up 15%.

- Fashion: 70%.

- Stationery revenue: Up 3%.

Three of these businesses have an online presence with that contributing more than $1,000 a week in revenue.

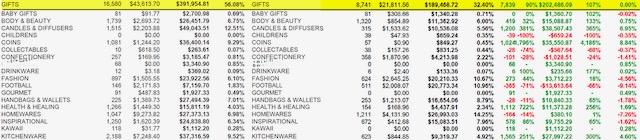

Here are the averages for business performance measurement points and categories across the whole benchmark data pool:

- Revenue: Down 3%.

- Sales transaction count: Down 7%.

- Basket value: Up 3%. This is an important number.

- Items per basket: Flat. This is an important number.

- Average item value: Up 2%. This is an important number.

- Greeting card revenue: Down 1%

- Magazines unit sales: Down 11%. This is an unfair measure because of the big difference between businesses, bigger than for any other category.

- Newspaper unit sales: Down 10%.

- Toy (incl. plush) revenue: Up 4%.

- Gift revenue: Up 10%.

- Stationery revenue: Down 5%. This is also an unfair measure because stationery now includes plenty of gifting items as it has changed.

The group of newsagents most at risk has not changed, it is those with minimal gift, toy and plush products, those not evolving fast enough.

Some traditional suppliers continue to let us down by not actively promoting our channel to attract new shoppers to us. Most newsagents attracting new shopper traffic are doing so on the back of their own local business efforts. Our suppliers need to serve us better.

If you want better results it is up to you to act.

There is no one size fits all solution, anyone who says there is is wrong.

The first step is to understand where you are at, from the data evidence in your business. next, you need a plan. Then, you execute with clarity and commitment, and draw on the support of others who have done this.

I own newsXpress, a marketing group supporting newsagents. newsXpress helps with this. If it interests you, please email help@newsxpress.com.au or call Michael Elvey on 0400 331 055 – he’s not a sales person, he’s part of the team nurturing success.

Mark Fletcher

M | 0418 321 338

https://www.linkedin.com/in/mark-fletcher-tower/