While there are regulatory processes to play out and finalisation is anticipated to be months away, the news yesterday that Bauer Media and Seven West Media had reached agreement for Bauer to acquire Pacific has captured the attention of plenty in our channel.

Bauer media and Pacific Magazines are the two largest magazine publishers in Australia.

The most common question in emails and calls that I received yesterday from newsagents was what does this mean for us?

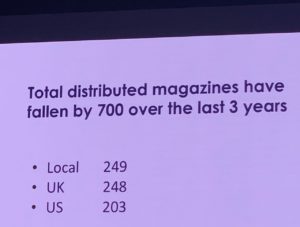

I think asking this question now is late. I say this because rationalisation of print media businesses has been happening for some years and has been discussed widely here and elsewhere in our channel.

If you are asking today what it means, you are already behind. If this is you, I encourage you to invest time now to catch up.

If the Bauer / Pacific news has come at a shock and you are wondering about the impact, act now, make decisions that focus on propelling your business forward. No supplier will do this for you – putting your business first in every decision.

While I don’t know what a Bauer acquisition of Pacific will or could mean, we can reasonably speculate that there will be changes over time. It cannot 100% be business as usual.There will have to be changes given the challenges faced by some of the titles involved. One benefit of single ownership of an expanded stable of titles at Bauer would be co-ordinated management of all titles. This could mean less cannibalisation between competing titles through more thoughtful and complementary coverage.

Many of us in the newsagency channel have been actively working on chasing net new traffic for categories outside of legacy product categories for our channel for years. There have been hits and misses through. Such is the experience of chasing change.

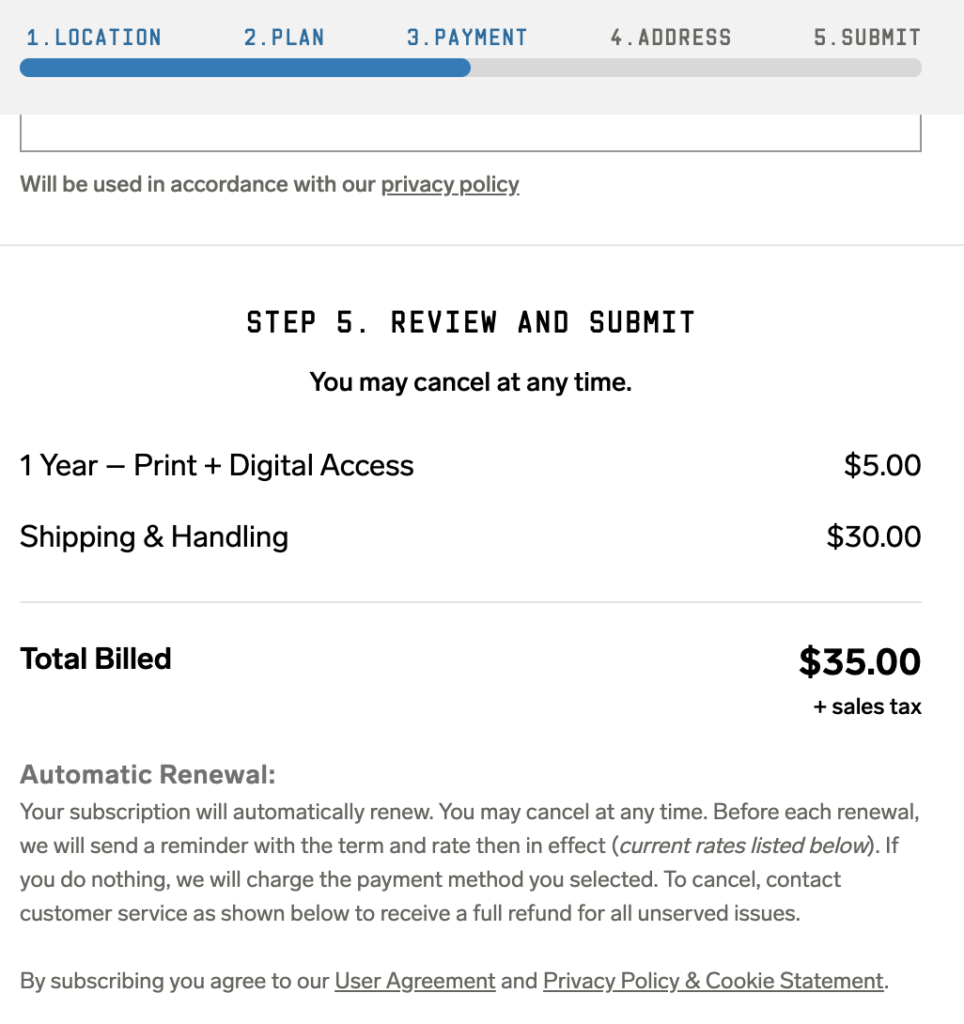

There is no doubt we are in a period of extraordinary change in print media. Change is being driven by how news is delivered into our hands, how and when we engage with news and information, what constitutes news and entertainment, what people will and will not pay for, who is a publisher (all of us?) and how print mastheads and stories are packaged and priced.

The Australian market is small. I think that is a factor playing out here too. Print media products need critical mass. We miss that in some markets here.

Thinking about what could change as a result of the announced acquisition… It would not surprise me to see: the days of magazine delivery changed, maybe to one a week; the closure of some weekly titles; the launch of a new weekly title; changes in monthly titles; greater accessibility for over the counter purchase of titles.

What should matter most to newsagents today is focus of the business changing net new shopper traffic, broadening the shopper appeal through new products, driving overall business GP%, growing online sales so the business is less reliant on local shoppers and chasing opportunities through pursuing what we don’t know our businesses can achieve.

The Bauer / Pacific announcement is an encouragement for us to work on our businesses, to pursue change, to make our businesses more valuable in the future.

All of this, of course, means more focus away from the newsagency shingle.