Customers will travel to a newsagency that has what they want

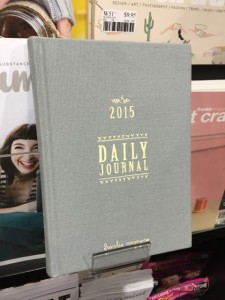

We have customers travelling through many suburbs to shop with us because they know we stock the Frankie diary. Having travelled for this purchase, they often shop the shop and select other items they like. We deliberately source items to interest the Frankie customer not just at Christmas but all through as is a demographically important and commercially successful magazine title for us.

We have customers travelling through many suburbs to shop with us because they know we stock the Frankie diary. Having travelled for this purchase, they often shop the shop and select other items they like. We deliberately source items to interest the Frankie customer not just at Christmas but all through as is a demographically important and commercially successful magazine title for us.

What we are doing here is a good example of how newsagents can use magazines to grow sales of other products under a popular magazine brand and unbranded products that will appeal to those who like the title.

We have been stocking the diary for some years along with the calendar and other items published under the Frankie brand. We chased the publisher and they ensured we got stock through the distributor.

I understand the temptation to say that it is a lot of work to do for one or two diary sales. To that I’d say it is not just one or two diary sales. Our basket analysis indicates it is considerably more than that. Our goal is to continue to evolve our offering to show the Frankie diary shopper that there are other reasons they should drive across suburbs during the year to shop with us and not just now for the diary.

We can grow our newsagency businesses by seeking out the hard to get products our customers are prepared to travel for. Sure it takes some work … the rewards are worth it!