How do you celebrate your business birthday?

In London recently I went to buy a coffee and discovered it was free because it was the birthday of the business. If you are ever in London and near Covent Garden, check out: www.lundenwic.com.

In London recently I went to buy a coffee and discovered it was free because it was the birthday of the business. If you are ever in London and near Covent Garden, check out: www.lundenwic.com.

Traditional newsagency businesses have no future if you consider the trajectory represented in the year on year comparison in FY 2018/19 financial year compared to the 2017/18 financial year newsagency fsasleds benchmark study just completed.

The study represents data from 157 newsagency businesses – city and country, high street and mall, banner groups and independent. Note: Each data point below is the average, mean, of all data for the data point.

OVERALL BUSINESS PERFORMANCE METRICS.

CORE PRODUCTS.

SPECIALTY PRODUCTS.

This year on year comparison is worse than we have seen in recent quarter analyses. This is in part due to a broader correction businesses. There is no one dominant group represented or one dominant type of business.

I have assessed each product category in isolation so as to not be distracted by businesses that are dominant in one and not another.

Print media.

Terminal decline. Publishers won’t like that representation. However, it is true if you look at the data from the last five years. There is no coming back from the eventual outcome, an outcome by the way I wish was not the case. In the meantime, we need to support the category and make the most of it, as the publishers themselves are doing.

Growth.

Less than 50% of the businesses that provided data had sales in the categories for which there was growth. This is a problem. There continue to be too many traditional newsagency businesses. That pure traditional model has no future.

There is plenty of good news. Look at Gifts. The average growth is 7%. There are many stores at 15%+ in growth. This is driving up the average. Typically, these are businesses in year two or three of their transition away from traditional newsagency operation and, often, focused on gift categories far removed from what you’d see in 98% of newsagency businesses.

City vs. Country.

Regional and rural businesses continue to perform better. This is across the board. Even when comparing pure traditional newsagency businesses this is true. Location does matter, at the moment. The difference will not last.

Upside opportunities.

Toys, crafts, coffee, books and plush offer update. However, in the traditional category of stationery there is upside too if you engage in a fresh way compared to what has been done in the past. Success requires the retailer being entrepreneurial.

The role of online.

Online should be accounting for at least 4% of revenue now. This is rare. However, I have seen it.

Is a newsagency a good investment? Can you make money?

Yes and yes, if you are good, engaged and focussed retailer. If you want a business that runs itself and ticks over, a newsagency is not for you. If you pine for a newsagency from the past, a traditional business, it has no future.

New traffic, better margin, genuine growth in business valuations all come from focussing on products not recently traditionally aligned with our channel.

I own three newsagencies. I am glad I do. I am pleased with their performance.

As to your situation, that is what matters more thank any benchmark. You are your most important competitor and your most important benchmark.

Mark Fletcher.

Email: mark@towersystems.com.au Website: www.towersystems.com.au Blog: www.newsagencyblog.com.au

M | 0418 321 338

Fifteen years ago we had a terrific time in the newsagency with everyday Halloween items that sold at $10.00 and less. Face masks, make-up, cobwebs, blood, pumpkin baskets and more were staple products for years.

Fifteen years ago we had a terrific time in the newsagency with everyday Halloween items that sold at $10.00 and less. Face masks, make-up, cobwebs, blood, pumpkin baskets and more were staple products for years.

Now, however, with supermarkets and discount variety in that everyday Halloween space, we have moved on in our gift / pop culture shop to cater to a more high-end shopper, someone looking for centrepieces and other horror related items, items usually associated with a popular movie of comic franchise.

This more curated approach allows us to play in the horror space all through the year and ramp things cup in October for Halloween. It works well. Key to success is having several offers in-store and with each featuring an eye-catching centrepiece. The only risk is for the stores in a major shopping centre. Landlords can be precious about scaring kids.

Halloween remains a good season. Indeed, I think we could grow revenue if we had some wholesalers prepared to play more in the niche side of the season, in areas such as homewares and higher end costume opportunities.

Halloween gives engaged retailers a focussed season for after Father’s Day and before Christmas.

Mediaweek is reporting of a restructure at Seven West that will see Pacific magazines fall under the new Digital division.

Seven getting new chief content officer in Warburton restructure

Warburton explained: “With the new organisational structure, we have focussed on simplifying the SWM organisation to enable our content led growth strategy. This new flatter structure will cement our position as Australia’s leading media group with content at the heart of the business, digital growth maximised, duplication of roles removed in all areas and operating efficiencies implemented.

“We have had to make some tough decisions in order to build the network for the future. I take very seriously any decision that impacts our people and I am grateful for the loyalty and commitment shown by our team over many years. Anyone impacted by changes will have dedicated support and respect throughout the process of transition.”

The change that will potentially make the most impact on the business is a new head of content. The existing content executives Angus Ross (Seven) and Therese Hegarty (Seven Studios) will report to the new executive.

The eight divisions will be:

Content (new appointment soon)

Revenue (where Kurt Burnette will continue to lead)

Marketing (new appointment soon, publicity wrapped into this)

Digital (new appointment soon)

Commercial (where Bruce McWilliam will continue to lead)

Finance

HR

Western AustralianPacific will now fall under the expanded Digital division with Pacific CEO Gereurd Roberts reporting to the new digital boss.

Seven West Media is also making extra savings of $10m in addition to a recent announcement of $20m in cost savings.

Now more than ever in media and business more broadly, change is front and centre.

I get to see plenty of retail in my travels. Shops that I find particularly interesting and inspiring I share on a Engaged Small Business Retailers Facebook group. Click here to register to join that group if you are interested.

From the Herald Sun today. Someone in News Corp. wrote the headline and multiple people in the editorial and production process decided it was okay to use it. It is a headline that pitches digital over physical, a headline that makes the brick and mortar newsagency channel less relevant in the minds of readers / shoppers. Shame on them.

While I am sure News Corp. management will say nothing was meant by this, such words would be hollow. They did it, deliberately, against the newsagency channel. As I noted, shame on them.

While I don’t see newspapers as relevant to my retail businesses, they are relevant to many of my colleagues, people who have been good and faithful servants of News Corp for decades. The same people accepting falling margins and actively promoting the News Corp special offers of books and the like that are loss making for newsagents.

This story is something newsagents may point to as they retreat from the shingle.

To be clear, I have no quarrel with News Corp offering content on Apple. It makes sense. My issue is with the headline for this article.

News Corp announced this on Twitter just now:

Apple’s subscription news service News+ has launched in Australia with News Corp Australia the exclusive local provider of news.https://t.co/parjiweqF8

— Australian Media (@aus_media) September 30, 2019

For transparency, here is the response I posted in a comment to the tweet: Okay, so it is not a news service. I see no point in paying for your political lobbying.

This video I made for social media has been terrific at getting people engaged with cards.

Our channel needs to do more to promote cards outside our shops, to draw attention to occasions we cover that others don’t and to shine a light on cards people can see themselves giving others.

The more people think about cards the more they become a thoughtful purchase. We play better in that thoughtful purchase than an impulse purchase.

Supermarkets and convenience stores are all about impulse. We are all about destination. For too long, however, we have relied on simply having a product category to drive traffic. That world is gone. We need to engage in myriad ways to attract shoppers and we do this by pitching categories outside our shops.

I was in a coffee shop that had recently switched to cashless. I like how the framed the move in this poster on the wall behind the counter:

No, I am not saying these reasons all work in a newsagency. Security and speed for sure do work. If I was going cashless, I think I;d use a sign like this as it is simple and cuts through.

On AFL Grand Final days past we have traded through to the usual closing time, filling the time after the game starts with planned changes to layout and product placement. This year, we have opted for a different approach. We are closing early.

We have completed significant floor changes already. Being open for significantly diminished revenue while Melbourne all but shuts down for the Grand Final does not make sense this year. So, we will try closing. We have let customers know I advance so as to mitigate disruption.

With each store earning significant online revenue, we will accrue sales that we can fulfil Sunday and Monday.

I was talking with a newsagent who had handed back their newspaper home delivery runs to the publisher as few months ago. They were telling me about customer experiences. They handed back the run because it was not financially viable and because representations to the publishers for fair compensation were unsuccessful.

Now, months after handing there run back, their old home delivery customers tell them that in the event any paper is missed, it is never replaced. The publisher provides a credit to the account as the only solution to them missed paper complaint.

What this experience demonstrates that the demand by publishers on newsagents that they take out a paper in the event of a reported miss is not a standard to which they hold themselves when they take over a run.

The publisher is demonstrating double standards. For decades they unleashed relentless pressure on newsagents in terms of home delivery service levels, demanding a c retain standard, a standard they themselves fall short of when they take over a home delivery service.

This failure by the publisher shows that the decades of demand were a big business bullying a small business because they could, not because it was right for the customer. I think this is poor social responsibility boy the publisher.

We are having terrific success with the Hallmark Keepsake ornaments this year and we are still 12 weeks from Christmas. By terrific, I mean revenue that is about to hit what we did all of last year through the season. This is a niche product that people travel for – it broadens the catchment area of the business, thanks to online.

Several newsagents have reported sales lower than expected sales from the $150M Powerball jackpot last week. Sales for the $100M the week before were good but the expected jump for $150M did not happen.

A couple of those I spoke with raised the question of lottery fatigue. That is, tiredness among lottery shoppers for jackpots.

Lottery fatigue is a real topic of discussion as you can see at the LA Times, USA Today, KOLO TV and MarketWatch.

While the big jackpots get all the media attention, every day there are winners of smaller am punts who are thrilled with their win. Even low prize wins of $10,000, $1,000 and less are a thrill for the winners, they are something worth celebrating.

One way to combat lottery fatigue at the shop level is to celebrate all the wins, no matter how small, and to pitch the thrill of each price being circulated back to the community.

I think focussing on the everyday when it comes to lotteries would be wise rather than the obsession of recent times on the massive jackpots.

Footnote: to any who say this post has been written to downplay or denigrate lottery sales – you are wrong. I hope newsagents have a bright future from lotteries.

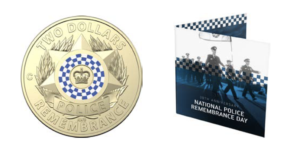

September 29, 2019, will be the 30th anniversary of National Police Remembrance Day, an important day in the calendar of serving and past-serving officers and their families.

September 29, 2019, will be the 30th anniversary of National Police Remembrance Day, an important day in the calendar of serving and past-serving officers and their families.

We are grateful for the opportunity to connect with the day through the sale of specially minted commemorative coins. The interest has been terrific. Because of how they are packaged, they have proven to be an excellent gift for customers to post to loved-ones.

What I particularly like about this day is the opportunity to reinforce niche gifts and to offer cards that support the niche gift giving opportunities. Through this we get to pitch our business as being more useful than many other gift related retailers. If you look around, it is easy to find plenty of niche opportunities for which we can pitch gifts and cards.

More broadly, from a category perspective, coins are proving to be valuable in revenue and the new traffic they attract.

This photo is the newsagent corner in a Sainsbury’s Local in Greater London, which I saw a few days ago.

This photo is the newsagent corner in a Sainsbury’s Local in Greater London, which I saw a few days ago.

Opposite this placement of magazines, papers, stationery and lottery products and our of shot is a small stand of cards.

Sainsbury Local is a small format, high street, supermarket. All the major UK supermarkets have small formal high street offerings, squeezing indie retailers out of this convenience space.

Given how much Coles and Woolworths follow UK supermarkets, we have to expect fine tuning of their small format high street offering. We see it in Australia already in fuel and in some city high street locations, but not to the extent of the UK.

Differentiation is key in retail. Always has been and remains so today. When it comes to the convenience space in the UK, the major supermarkets all look pretty much the same. From what I can see they rely on their loyalty programs and myriad price-based offers to drive traffic through their doors.

The Flinders News has published an opinion piece on the future of local milk bars and newsagencies.

While I get that the topic is interesting, I am yet to see any piece look at it thoroughly and shine a light on the many in the channel innovating and creating more value in and for their businesses. There is much good news out there if only people would look.

10% of revenue earned by Myer now comes from online. 23.5% of lottery revenue for Tabcorp comes from online. Now more than ever, online is critical for retailers.

In this free workshop I will look at trends, share real-life newsagency case studies and explore:

Each workshop will be live and interactive and relevant to your type of business. This will not be a sales pitch. We will share what we know having done this work ourselves for the retail businesses we own in the homewares, pop culture, collectible, plush, gift and games segments of retail.

I will also cover: SEO, shipping options, free shipping, the role of social in online sales, returns, bundles, branding and a plan b for your web strategy.

Click on your preferred city below to book. Each workshop (except for online) will be in an easy to get to capital city location.

With these workshops a key goal is to help you enjoy a more successful and valuable business.

The bagging / bundling of magazines started in the UK years ago. Then, it came to Australia.

The bagging / bundling of magazines started in the UK years ago. Then, it came to Australia.

In London over the last couple of days I’ve seen bundled offers easily available, begging the question: Is the cover price of individual weekly magazines redundant?

This bagged pack in the photo offers four titles for £2.95. My understanding is that in this bundle, OK! is the hero product, the one on which the bundle price will be judged. We see similar moves in Australia with the hero product leading the bundle.

With magazine sales continuing to be challenged, I suspect we will see more bundling and less reliance for individual cover price.

The recently launched Stat house brand of stationery from GNS is a terrific opportunity for newsagents to grow stationery sales.

The recently launched Stat house brand of stationery from GNS is a terrific opportunity for newsagents to grow stationery sales.

I say that having looked at a range of the Stat products, listened to how the brand came about and the quality guidelines set for the products in the range and after looking at similar house brands offered by key competitors of newsagents in the stationery space.

From the bold and well-defined packaging through to the each product in the range Stat is an excellent opportunity for newsagents who want to compete in a competitive stationery marketplace.

What I particularly like is the education offered to newsagents, to understand that Stat is not about replacing current known brand stationery. rather, it is a brand through which to broaden the appeal of the newsagency as an outlet for a value stationery offer.

I am grateful to the CEO and GM of GNS for the time they have provided recently to facilitate understanding of the work done to bring Stat to the market and the opportunity this affords newsagents.

If you are encountering tough competition at the value end of stationery, I suggest you look carefully at Stat and consider ranging it with all Stat products placed together in-store for a visually impactful display and supporting this with an out of store campaign to position you to the target shopper.

Our channel used to dominate stationery sales in Australia. Stat offers an opportunity to reclaim some lost ground.

We are having terrific success with a thoughtfully curated range of gentle sarcasm products sourced from six different suppliers.

The pitch in-store is encouraging existing shopper engagement while individual product pitches out of store are working too.

It is ine thing to have access to good products through which to attract new shoppers and another entirely to craft a narrative across produces from multiple suppliers that appeals to a specific co-hort, heeling them to see purchase opportunities in your business they have not considered shopping with you for.

I think engaging like this is critical – broad range glued together with an appealing narrative but with a stock weight that is not burdensome … selling through and freeing the space for the next story.

Change is wonderful.

This magazine wall we have in one of my shops remains an important part of the business. While it is on a black wall, it can be seen from outside the shop, in the mall. The range works for us and only rarely are we asked for titles we do not stock. It is a busy part of the business, one we will maintain.

I mention this as I am regularly asked about plans for magazines in my own businesses.

This next photo is from the Woolworths George Street Sydney store. It’s upstairs, on level 1. I visit it every time I am in Sydney, usually every couple of weeks. What Wass once a busy section ra4rely has shoppers when I visit.

Their range is not as deep. It does not have the specialisation you can find in most newsagencies.

I think specialty titles are more important to our channel now than the weeklies and major Aussie monthlies. While these titles do matter, it is the niche titles our competitors do not carry that will keep shoppers shopping with us.

The Australian and Mumbrella are reporting the end of newsagent led News Corp and Nine newspaper product home delivery by newsagents in Sydney.

Australia’s two biggest newspaper publishers, Nine and News Corp, will cease newsagent-led home delivery for their print titles in the Sydney metro area. This excludes CBD delivery.

According to a Nine spokesperson, the move is necessary to ensure the model is sustainable.

The move means newspapers will still be delivered to subscribers’ homes, however the service will not be provided by local newsagents. Instead, News Corp will appoint a single distributor for its deliveries as of early 2020, while Nine will use two.

Nine announced its plans to change the distribution for The Sydney Morning Herald and The Australian Financial Review in a letter to newsagents last week, while News Corp announced its plans in June. News Corp is the publisher for The Australian and The Daily Telegraph in New South Wales.

Some online have read this as the end of print delivery altogether. It is not.

It is almost seven years to the day since the News Corp T2020 project was announced to newsagents. The decision by News and Nine to have newspaper home deliveries managed by a distributor is the next step in the roll out of the remnants of that project.

On one hand, this move is another attack by these big businesses on the businesses of small business newsagents, businesses that have faithfully and cost effectively served the publishers for decades. On the other hand, it is an opportunity for newsagents to be done with newspaper home delivery and thereby rid their businesses of a service for which they received a fraction of minimum wage to fulfil.

To those outside the channel, yes, this has been seven years in the making. The main impact will be from ignorant accountants and bank managers who think its will negatively harm the value of businesses. For the most part it will not.

The publishers are doing this because they think it will save them money and / or help them maintain newspaper home delivery for a while yet. I don’t see that happening. There are too many days of the week when delivering newspapers to homes are loss-making. Business managers with an eye to profitability will prevail and at some point, home delivery seven days a week will cease. That will be a sad day.

One measure of strength of conviction of an online commenter here or anywhere is whether they own what they say. By own I mean are prepared to put their name to what they say. Here are two comments from last night. Neither made it through as they were the first by each email address used. While I don’t moderate comments, the first sits in a queue for approval as part of the blogging platform protocol.

If this commenter would care to provide real details, the comments can run as everyone is entitled to their views.

I’d be happy to meet and introduce them to plenty of retailers in this channel who are doing well, growing and navigating to bright futures.

I am in Cairns at a newsagency conference and there are plenty here who would disagree with the comments.

Meanwhile at the Newsagents….Good work Citizens!🦖🇪🇺 @EUflagmafia @Doozy_45 pic.twitter.com/tAYCjWWXis

— T-Rexit! Esq. #FBPE #EUFM #HAAS 🇪🇺🏴 (@ItRecks) September 10, 2019