Carey Grammar in Melbourne closed yesterday on the news of a teacher being diagnosed with Coronavirus.

A Walmart store in the US remained open after a staff member was diagnosed with Coronavirus.

The Coronavirus situation is fluid and challenging. A check of state, federal and local government websites for what businesses, like retail shops, should do in the event of a diagnosis nearby, of a staff member or a customer does not provide clear advice.

It is important we in business have contingency plans. They are part of any disaster planning. At my retail POS software company, a month ago we worked through how we’d handle the whole business operating from home. It is the type of business where we can do that. retail is different. Retail needs customers.

Retailers with a strong online business are better positioned as there is this on which to fallback to a certain extent.

I think it is important that you have a plan in the event an employee is diagnosed or a regular customer is diagnosed.

I think it is important that you have a plan should your shopping precinct be closed for a time.

I think it is important you have a plan should shopper traffic decline significantly, 25% or more, as a result of the virus.

- Can your business cope with closure for a day, week or month?

- Do you have an action plan in the event of closure? Supplier notification, employee notification etc.

- Do you know what deliveries are planned by day, a month out?

- Do you have what you need to be able to work from home?

If you think this reads as unnecessary, think about what has happened in Italy in the last few days. There are plenty of big businesses in Australia this week testing different approaches of working from home, working from another location. It’s prudent business practice to be prepared. That is all I am suggesting here.

For suggestions for shop management, see my post from Jan 29. My suggestions for the shop itself remain – stay positive, offer a clean and upbeat experience, don’t engage in herd mentality retail, don’t try and profit from this.

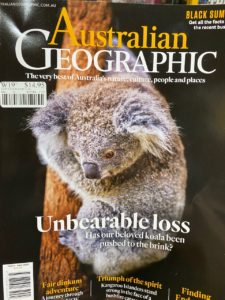

This issue of Australian Geographic magazine is perfect for pitching at the counter. Shoppers will buy it for themselves and as a perfect gift for someone overseas. The koala is adorable, the image timely.

This issue of Australian Geographic magazine is perfect for pitching at the counter. Shoppers will buy it for themselves and as a perfect gift for someone overseas. The koala is adorable, the image timely.