Newspower has rebranded for the fourth or fifth time with an announcement earlier this week. It has also announced a new level, Newspower Go. This is like Newspower level from some years ago – more discipline, better deals.

While I think Newspower does need to change, parts of the announcement are problematic in my opinion:

Newspower has undertaken significant research across not only the Newsagency industry, but the broader retail sector and as a result Newspower has developed key strategies to deliver Newspower a stronger future.

Newspower ought discslose to its members the detail of the research and the detail of the resulting strategies as the organisations track record is not great – to give confidence that they have a good plan and that the plan is based on sound research.

NewspowerGo stores will be in targeted locations, designed to attract and engage with younger shoppers; Generation X and Millennials – those that will become your customers into the future.

Gen X and Millenials are newsagent customers today. Strategies to attract them were needed years ago. There are newsagents enjoying terrific success with these generations.

Stay tuned – the first NewspowerGo stores are scheduled to be opened later in the year.

This makes the an announcement that there will be a further announcement. Newspower is coming at this transformation very late. They should have stores running now so the announcement earlier this week was here – come see it live.

We are entering a new era of growth and development and as part of the launch of NewspowerGo we have also refreshed the branding for Newspower. Newspower was established over 20 years ago and is the Largest Newsagency Marketing Group in Australia and our brand is strong.

Newspower has, from what I understand, user 600 stores. This is down from something like 1,200 stores a few years ago. considerable decline in numbers does not represent strength. If I was leading Newspower I’d pull back from talking about size and focus on stabilising member numbers and then achieve growth before talking about growth.

I am a director of newsXpress, a competitor of Newspower. The weakness of Newspower in recent years has hurt more than Newspower and member businesses, it has hurt the channel. This is why Newspower has to get it right, why they have to fix their situation to drive the viability of member businesses. The rest of the channel is depending on it.

Newspower should start by developing its own ideas. I had to ask a Newspower staffer leave a confidential invitation-only session I was speaking at recently. I only realised they were there soaking up commercially sensitive ideas when someone else pointed it out. I wrote to Helen Dowling about this on June 17 and am yet to receive a response.

Our channel will benefit from strong competition between all of the marketing groups. The key word is competition. Competition has its roots in being difference, not copying. It benefits from being first with initiatives, not years late.

Historically, Newspower’s biggest challenges have been a weak uninspiring board, GNS controlling key marketing seasons and control at the state level on what is done under its name. For the future to be bright these three things need to be addressed.

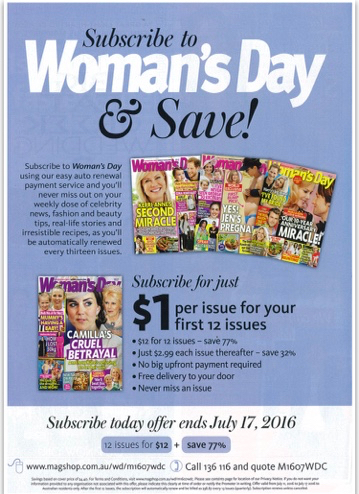

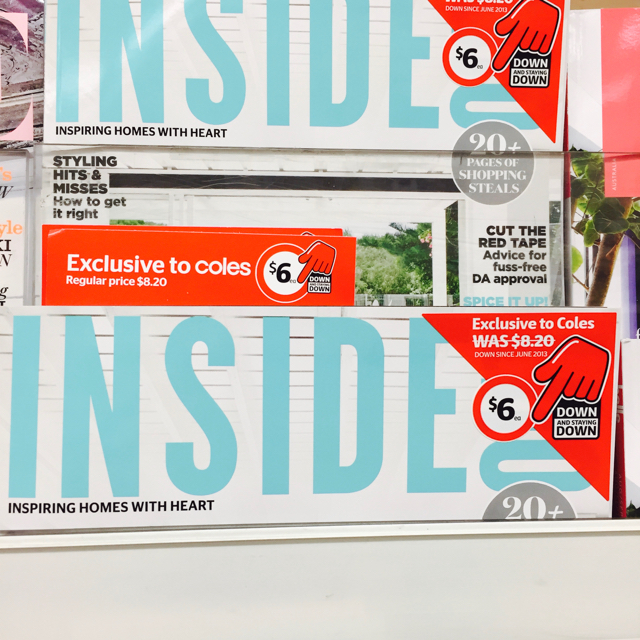

This triple-pack of discounted magazines from Bauer Media Thursday this week had newsagents scrambling for extra space in the magazine department as it is a new title, an expansion in the busy weekly title section.

This triple-pack of discounted magazines from Bauer Media Thursday this week had newsagents scrambling for extra space in the magazine department as it is a new title, an expansion in the busy weekly title section.