No upside in over the counter bill payment

I do not see any upside in over the counter bill payment for newsagents.

With online widely available and becoming more secure, the barriers to online payment are reducing.

Suppliers, too, are embracing online, offering rewards for paperless (online) transactions.

Banks and suppliers, too, are making scheduled payments easier and this helps with family budgeting.

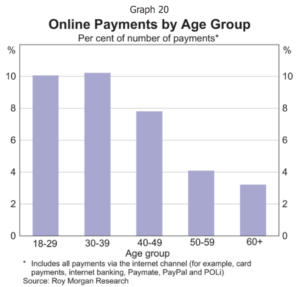

A study from 2011 by the RBA provides the most recent insight into this area of online bill payment.

While these are important, the other factor for counter (OTC) bill payment is the demographic. OTC bill payment customers are likely to be older. This means a higher time cost to process, more complaints and less likelihood of add-on purchase. These three points are based on anecdotal evidence from recent years.

While these are important, the other factor for counter (OTC) bill payment is the demographic. OTC bill payment customers are likely to be older. This means a higher time cost to process, more complaints and less likelihood of add-on purchase. These three points are based on anecdotal evidence from recent years.

If we go back to the time of Bill Express, the OTC bill payment service on which newsagents lost tens of millions of dollars, shopping basket data from that time revealed 80% of bill payment transactions were bill payment and nothing else. So, there is an efficiency question for retailers – efficiency not only at the counter but in terms of space used in-store to pro one the service.

Another consideration is the growth opportunity. Will OTC bill payment grow? Unlikely. There are many other upside opportunities available to newsagents.

For me, though, the biggest factor in the consideration of OTC bill payment is that it is agency business, business for which the retailer receives a small fee that is unlikely to reflect the true cost of providing the service and that in providing the service higher margin opportunities are interrupted or stopped. It is not good business in my view, it does not fit with my business model.

Once I define myself as a retailer, decisions about agency lines is clearer.