Newsagency marketing tip: leveraging passion

One of the easiest ways to attract a new shopper into any retail business is to pitch products that connect with passion(s), theirs or those for whom they purchase gifts. Some passions are easy to spot while others are obscure.

One of the easiest ways to attract a new shopper into any retail business is to pitch products that connect with passion(s), theirs or those for whom they purchase gifts. Some passions are easy to spot while others are obscure.

Once you have found products that can tap into a passion, like Kombi vans, the best marketing approach is too pitch outside the business, using social media. I have found a simple post with a good image can be widely shared. better still, I have found it can generate net new traffic for the business.

The success of this marketing approach starts with sourcing products that connect with passions.

Remember, your key target is the shopper buying for the person with the passion.

Newsagency managent tip: selecting gifts for the business

Take a look at card sales by caption, work out the percentage of each. Use that percentage breakdown as a guide for the percentage allocation of gifts for those occasions in your gift department.

Too many newsagents buy gifts for seasons. That approach will not help you achieve the gift sales you could achieve.

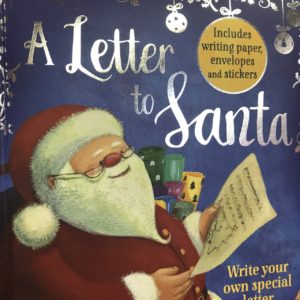

Christmas 2017 is good already

While we are still nine days out from Christmas, the season this year is already quite different to recent Christmas seasons.

While we are still nine days out from Christmas, the season this year is already quite different to recent Christmas seasons.

My experience and the experience of folks I have spoken with in a range of situations is that people are shopping sooner and they are spending happily.

Purchases are across the board: cards, ornaments and decorations, gifts as well as everyday items.

One newsagent in regional Queensland contacted me yesterday with the news that their gifts are top 48% off a terrific base and cards are top 12%, also off a good base.

I know of several newsagents who purchased large, expensive, centrepieces for Christmas window displays only to have them purchased by customers in a day or two.

While I don’t want to jinx trading between now and next Saturday, I’d say we are having a good Christmas in retail.

Christmas is a season when the maxim – we make our own success – is true. For this season, making our own success means thoughtful buying, in-store storytelling, in-store basket depth driving tactics, out of store marketing and keeping it fresh, every day. It is hard work, starting from the end of the first quarter. The results are worth it.

What I love them most about Christmas is that we see many new faces and each is an opportunity to pitch a return visit after Christmas. A good Christmas is one step, of many, to a good following year.

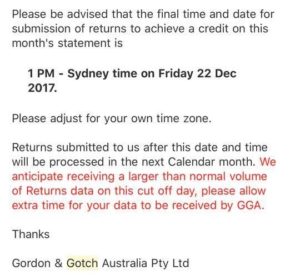

Gotch decision on Christmas returns cutoff expected to increase early returns

Gotch has advised newsagents 1pm December 22 is the last date/time for submission of returns for December. I expect this will result in a higher than usual early returns. It is disappointing Gotch is pushing on to small business retailers the burden of the week earlier than usual returns processing cut-off. This is poor customer service.

Gotch has advised newsagents 1pm December 22 is the last date/time for submission of returns for December. I expect this will result in a higher than usual early returns. It is disappointing Gotch is pushing on to small business retailers the burden of the week earlier than usual returns processing cut-off. This is poor customer service.

UPDATE: I have been contacted by newsagents who have received an updated email with a cutoff of December 28. If this applies to everyone it is good news.

Good campaign on retail employee abuse

It is good to see the issue of abuse of retail employees by customers get considerable coverage in the last 24 hours. The campaign has grown out of a survey run by the Shop, Distributive and Allied Employees Association. This is good activity by a union.

In our channel, regular abuse is from customers throwing money for a newspaper because they are angry at the prospect of waiting to pay. At the other end of the scale, some newsagency employees have experienced awful physical abuse while others has experience dreadful verbal abuse.

Working in retail can be tough. Especially this time of the year.

GNS acquires Satex in SA

The announcement:

GNS acquires Satex, completing its national wholesale footprint

GNS Wholesale (‘GNS’) today announced it has signed an agreement to acquire the business and operations of Satex Distributors (‘Satex’) from its owners, Ron Vanderloo and Trevor Green. Operating for over 40 years, Satex is an Adelaide- based wholesaler of of ce products, education and art supplies focussed on the commercial dealer market.

Satex supplies over 250 customers throughout South Australia and the Northern Territory on a daily basis from its approx. 1,200 sqm warehousing and distribution facility in Marleston, South Australia.

The acquisition of Satex enables GNS to better support its customers with a national wholesale footprint, adding cost- effective distribution capability in South Australia and the Northern Territory. GNS’s ownership will also provide a broader and deeper product range and service offering to existing Satex customers. Ron Vanderloo will remain with the business, which will retain the Satex Distributors name, and oversee both the enlarged Adelaide-based operations and the integration of Satex’s business into the GNS group.

Paul Yardley, CEO of GNS Wholesale, said, “I’m pleased to announce the acquisition of Satex, creating a true national wholesaler and bringing a new customer base to GNS. This transaction completes our ability to service accounts nationally and provides suppliers with signi cant ef ciencies. Ron and Trevor have built an excellent business and I’d like to welcome Satex employees to the GNS family.”

Ron Vanderloo, joint owner of Satex, said, “Having owned the business for thirty years, given the consolidation in our market we decided now was the right time for Satex to join a larger group. This transaction protects the future of our business and its employees, and I am excited to be working with GNS to bring new opportunities to customers while retaining all the bene ts of dealing with Satex.”

Terms of the acquisition are con dential and have not been disclosed. The acquisition is expected to take effect on or around 1 January 2018 and will be funded from GNS’ existing cash resources.

Why I don’t take cards off the wood for seasons

I think taking cards off permanent fixtures to make room for seasonal cards is a mistake. If non-seasonal cards are good enough, valuable enough, important enough to be given space on permanent fixtures then they deserve that space all through the year.

People die during seasonal card buying occasions. They get engaged too, and marry. Babies are born. People have birthdays!

You can’t sell cards that are in a drawn.

Typo pitches $1 Christmas cards

Typo has a good range of $1.00 Christmas cards, pitched different to the cheap Christmas cards you see elsewhere.

Typo has a good range of $1.00 Christmas cards, pitched different to the cheap Christmas cards you see elsewhere.

Given the shoppers Typo typically pitches to, this range could do more to introduce people to buying cards than taking sales from more traditional outlets. That is what I want to think at least.

Peak teacher gift giving season

We are in the middle of the peak end of school year opportunity. This is an interesting season in that there are traditional for teacher gifts parents choose and there are gifts teachers would like. They are quite different.

We are in the middle of the peak end of school year opportunity. This is an interesting season in that there are traditional for teacher gifts parents choose and there are gifts teachers would like. They are quite different.

We have teacher cards pitched at the counter, where they are selling well. Due to space, were have gifts located elsewhere in the business, with appropriate call to action signage. We have also been pitching on social media.

Allied to this is the teacher to student gift giving opportunity. We have had some success offering teachers a bulk deal for a class-size purchase.

All in all the end of school year season is a good opportunity that engaged retailers can leverage. The keys are serving the broad range of opportunities and promoting your position in this space outside the business.

Pitching Hanukkah cards at the counter

We have this Hanukkah card at the counter with Christmas cards from the designer range. These cards are not a top of mind purchase, hence the placement at the counter. The work well as an impulse purchase. They are help speak to the broader appeal of the business.

We have this Hanukkah card at the counter with Christmas cards from the designer range. These cards are not a top of mind purchase, hence the placement at the counter. The work well as an impulse purchase. They are help speak to the broader appeal of the business.

While Hanukkah isn’t the “Jewish Christmas”, it occurs at a similar time of the year. Having the cards enables shoppers to respect jewish friends at the same time as they share Christmas greetings.

If you see yourself as a card specialist / destination, having Hanukkah cards is important.

Money wasted on these newspaper inserts

I feel for the companies that paid to place inserts in the Herald Sun yesterday. The photo shows the stack of inserts that fell out of the newspaper at a gate at Melbourne Airport. I saw one customer pick up the paper and the inserts dropped out. They picked up a couple of inserts, looked at them, and dropped them back in the pile.

I feel for the companies that paid to place inserts in the Herald Sun yesterday. The photo shows the stack of inserts that fell out of the newspaper at a gate at Melbourne Airport. I saw one customer pick up the paper and the inserts dropped out. They picked up a couple of inserts, looked at them, and dropped them back in the pile.

This photo is from one departure gate at Melbourne airport. I suspect the same mess would be at each of the gates.

I suspect there were many inserts dropping out of the Herald Sun yesterday. I wonder if happened because of the number of inserts in the paper compared to the weight of the base newspaper. The inserts appeared to fall easily.

Maybe people are less concerned about inserts when they get a free newspaper. I suspect not given the mess I see fall out and left behind in the newsagency some days.

If I was an advertiser and I saw the mess I’d be raising it with the publisher.

Maybe a newsagent with a security system in-store and with a cameras covering the newspaper stand could fast forward through footage. It could be useful evidence of how shoppers react when inserts fall out.

The future of online lottery games including instant games

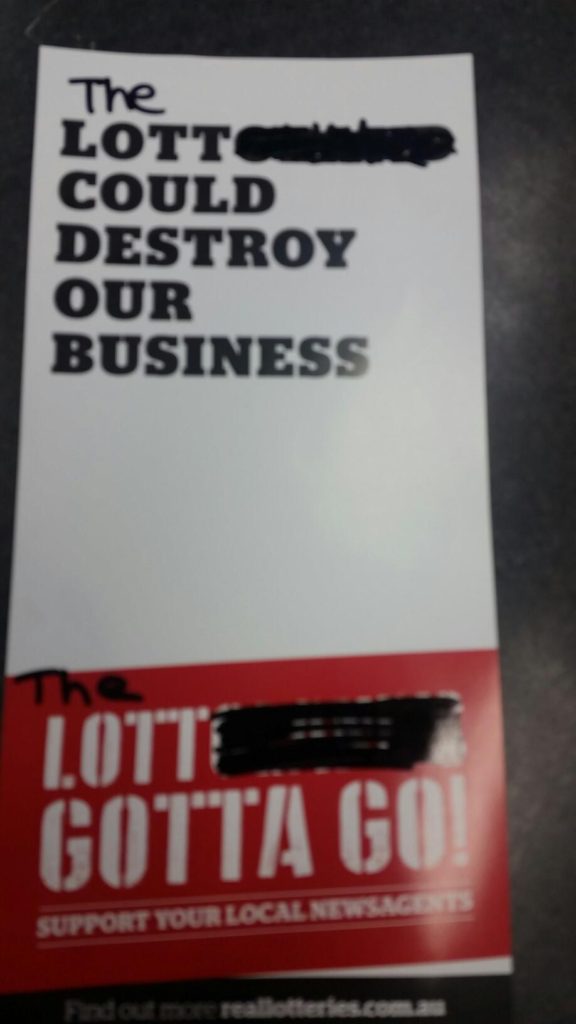

In a report published by Pennsylvania Inquirer, lottery players in that state are soon to get access to online gambling, like we have here through The Lott and other platforms. The report also foreshadows a move to reimagine instant stretch ticket games for the online customer.

The Pennsylvania Lottery hopes to do that by creating “totally new concepts” for the instant-win games offered online. Details about how exactly the games will work are still being figured out. The new games will be similar to some sold in other states, like Michigan, which is considered the most successful iLottery state.

“It’s really meant to just offer a different type of entertainment to a different audience,” Svitko said. “We believe the most responsible way we can grow our sales is to grow by reaching new players in new ways and not just by asking existing players to spend more.”

“We are working feverishly to try to figure all of it out,” he added.

Instant games bring in the most revenue for iLotteries across the country, according to research by Bogus’ group. An analysis showed that in Michigan the iLottery was growing rapidly — reaching $1 million by February 2017 — with retail sales nearing record highs.

In Michigan while they sell lottery tickets online, they are yet to offer instants on phones and tablets. Indeed, when you go to the Michigan lottery website, they make it easy for shopper to find lottery retailers:

Tatts should do this rather than their current approach of all but hiding their retailers.

All it will take is for one lottery provider to nail offering instants on mobile devices for others to follow. As we see from other games on mobile devices, the tech is there today.

Newsagency management tip: look at your opening hours

It is important to open your retail business in the morning at the right time. The right time the time from which it is financially viable for you to be open.

Historically, newsagencies have opened early … 6am often, 5am in country town locations, even earlier.

Look at your data, track your revenue and gross profit. Consider other tasks that are done in the early hours. It could be that you can trim your hours without any significant negative impact on the business.

Years ago in a newsagency I owned we moved fro a 7am opening to 8am. Some customers complained, saying they would never shop with us again. Few who complained acted on their complaints. We cut labour costs by $150.00 a week. The GP for sales in an average week for that first hour tracked at less than $100.00. The decision made sense.

This is how to look at your opening hours, though the numbers. Even if your decision ultimately is to not change your hours, it is valuable to run the numbers, to make an assessment based in the facts.

Newsagency marketing tip: be unique in what you sell

Packaging items together to create a unique item is a terrific way to position your business away from others with similar products.

Packaging items together to create a unique item is a terrific way to position your business away from others with similar products.

While other retailers may sell journals, erasers, pencils, rules and similar products. Only you might have the items in a package under a name you created. The photo shows how a premium stationery brand does this.

You can create a unique package with what you have in your shop today. You could package together based on function, colour, brand or more.

For what it is worth, I think packaging by colour is a good starting point.

No, Gotch, we don’t want your low-margin bracelets

Magazine distributor, Gordon and Gotch this product these to newsagents this week with magazines. I highlighted magazine distributor because they should get that right first.

Magazine distributor, Gordon and Gotch this product these to newsagents this week with magazines. I highlighted magazine distributor because they should get that right first.

I, like plenty of newsagents, already had the product, sourced direct.

From Gotch I’d make 25% whereas from the direct supplier my GP is twice that.

What a frustrating situation!

So, I am returning the stock to Gotch. Here is the unopened box. Dead stock.

So, I am returning the stock to Gotch. Here is the unopened box. Dead stock.

A waste of money for me and for the supplier who paid to get it delivered to me any many others.

Dumb.

However, I should not have to return it. Gotch should not have sent the stock. It is not magazine related. The margin is appalling, offensive even. Their arrogance is sending it lands my business with a returns cost that is unfair. They decided to risk this new products, a product from a category unrelated to their core. The problem is theirs, not mine.

It is situations like this that get newsagents closer to thinking why bother with magazines?

Lottoland CEO reflects on retreating from selling best in Australian lotteries

9 News ran a story two days ago on Lottoland in which Luke Brill, Lottoland CEO, made some comments newsagents may find interesting:

“What Tatts wants to do is to protect the online space. They don’t care about the newsagents really, so when this obviously natural transition happens, it’s got nothing to do with Lottoland – it’s to do with the internet,” said Brill.

“People’s behaviour is changing. You don’t go to the video store anymore; you go to Netflix.

“Unfortunately, the reality is that for the next generation of people coming through, it’s unlikely they will go to newsagents to buy a lottery ticket.”

Stunning early boxed card results

I have data for a small suburban store that has clocked 825 units of boxed Christmas cards up to earlier this week. That is well over $10,000 in revenue from a category in which this business had not focussed in the past.

Thanks to simple, consistent, social media messaging, thoughtful in-store placement and a small footprint counter pitch, the boxed Christmas cards are selling like hot cakes.

Whereas the previous owner had the view boxed Christmas cards don’t sell here, the new owner decided to not manage to meet low expectations. This is important as it allowed the business itself to show what I could achieve.

For years, this business was run based on the assumptions of what the owners knew would work yet here we are under new ownership and seeing what can work.

While you may hear you are not your customer from suppliers and others in the newsagency channel including me, it is hard to live up to that, it is hard to be genuinely open to what a business can do … especially if resources are tight and your capacity to weather mistakes is limited.

My advice is to work at being open, at giving your business opportunities to surprise you. Be drawn to those who will challenge your view. Take time to consider suppliers who were told by previous owners their products would not work.

This business, in less than a month, has added over $6,000 in GP from a product category that the previous owners rejected year after year because of their belief it would not sell in that location.

Is the UK campaign against The Sun influencing campaigns here?

The campaign in the UK against the Murdoch owned The Sun newspaper is legendary, with plenty of newsagents being public about their refusal to stock the title. Given this tweet in the lead up to the Queensland state election I wonder if about the traction for a similar campaign here.

The campaign in the UK against the Murdoch owned The Sun newspaper is legendary, with plenty of newsagents being public about their refusal to stock the title. Given this tweet in the lead up to the Queensland state election I wonder if about the traction for a similar campaign here.

Australians are no longer influenced by @rupertmurdoch propaganda rags and will continue to #BoycottMurdochMedia every day. I actually saw a sign up in a newsagents window saying “We don’t sell Murdoch’s propaganda rags here” 😂 I Love democracy #QLDvotes #Auspol #insiders #qt

There is the question of the role of the newsagent as censor and there is the question of the role of any newspaper in engaging in an overt political campaign to serve it s own interests as we have seen in recent years in Australia.

Carte Blanche closing in Australia

After a review of its Australian business, UK card company Carte Blanche is closing its Australian branch. My understanding is staff finish up this week, someone told me it is today. Simson is taking on the card range and Jasnor is taking on the plush range.

I have not seen communication from Carte Blanche so I do not know the arrangements for returns.

The challenge of launching a new magazine in Australian newsagencies

The days of newsagents allocating a third of their retail floor space are long gone, and with that the space to easily accomodate new titles.

Today, magazine space is tight, usually taking 20% and less of floor space, often floor space that is less prime than the magazine bays of years ago. Whereas in the past the volume of stock received managed newsagents, today newsagents are far more protective of their assets, as they should be.

With the scale back of space allocation for magazines is the almost elimination of power end displays promoting magazines. They don’t provide the financial return necessary in Australia’s high retail space and labour cost climate – when you compare the cost of retail space and labour to other developed countries.

I consider any new title on the basis of what it can bring to my business, like I do for any product. While adding a new magazine that leeches off existing traffic is okay, it is not as beneficial as the magazine that helps attract new shoppers.

This is on my mind today because Lovatts Media has launched Teen Breathe. I have read the material and while I appreciate 30% gross profit compares to the usual 25%, there is nothing indicating what adding this product to my business will do to grow the business. What is offensive is that the 30% is tied to newsagents not early returning the title. That is, an extra 49.75 cents per copy sold, but only if we hold the title in-store for two months. This is disrespectful. It is of no interest to me.

RETAIL NEWSAGENCY SALES BENCHMARK RESULTS: New product categories key to helping newsagents overcome collapsing magazine, newspaper and stationery sales.

RETAIL NEWSAGENCY SALES BENCHMARK: JULY – SEPTEMBER 2017 vs. 2016

New product categories key to helping newsagents overcome collapsing magazine, newspaper and stationery sales.

The July – September quarter continued the tough year for traditional products in Australian newsagency businesses.

The gap between businesses enjoying success and those challenged increased.

The traditional newsagency has no future. That is, the business with newspapers, magazines, lotteries, stationery and cards. Quarter after quarter, the performance on those businesses continues the trajectory of declining traffic and revenue, which can only end in closure.

At the other end, businesses that have diversified into products that are not traditional in range and price point for newsagencies are more likely to (but not always) find success.

Business closures.

Before I get into the benchmark results, I want to address another data point, store closures. It looks like 2017 will end with between 400 and 450 newsagency business closures. The number is difficult to tie down given there is no one place all newsagencies are registered.

The question is: – is this rock bottom, is the closure number for 2017 the worst we will see? Only time will tell. I suspect 2018 will be an equally tough year. I say this based on the number of newsagency business owners who refuse to dramatically alter the course of their businesses, expecting traditional suppliers to bring the change necessary to turn the business around.

The reasons for closure vary from financial trouble to lease costs to retirement to in ability to sell and no will to keep running the business.

Business performance data do not lie. The best performing businesses in the newsagency channel, which includes businesses some would no longer call newsagencies, are those trading away from traditional categories. These businesses still have some of the traditional categories but they do not rely on them at the core of their businesses.

Business closures can be avoided, if there is will, early will, on the part of the business owners. There are plenty in the channel who can provide real help. The key is to ask.

Benchmark headline numbers.

Here are the headline numbers by key product category:

- Magazine unit sales declined 13.5%.

- Greeting card revenue declined 4%.

- Lottery revenue declined 2%.

- Newspaper unit sales declined 12%.

- Gift revenue increased by 13%.

- Toy revenue increased by 12%.

- Plush revenue increased by 14%.

- Stationery revenue declined 11%.

The above percentages reflect the overall performance of the 173 newsagency businesses in this benchmark study. It includes stores from a range of banner groups as well as independents. There are large businesses and small. Some are in shopping centres while others are on then high street.

What is concerning is the pace of decline of what were once core traffic generation – magazines and newspapers.

Newsagency businesses that are not engaged with a net new traffic strategy are heading for trouble.

Newsagents need to manage the overhead cost of newspapers and magazines. Labour, space and capital investment must reflect the gross profit contribution of these categories.

Stationery was a challenge this quarter. Looking more closely at the data, it is the higher volume business, OfficeSmart type volume business, where there are challenges.

That card performance this quarter matches the previous quarter is a concern. Looking at stores reporting growth, one factor is how cards are managed – active management by the business, as opposed to the card suppliers, is key. The card department is no longer a department we can expect to work without management support.

GOOD NEWS.

Yes, there is good news.

- One store achieved $58,000 in everyday and higher end plush sales in the quarter, up 20% from the same quarter a year back.

- A suburban store grew plush to $17,000 in the quarter, up 30% on 2017.

- A regional high street store grew gifts to $38,000 in the quarter, up 22% on 2016.

- A small country town business entered toys earlier this year and in the July – September quarter tracked $4,900 in sales in a category in which they had no presence a year earlier.

- A suburban newsagency entered the games category this year and booked more than $8,000 in revenue from games in the September quarter. That is 100% new business.

- Plenty of businesses reported gift revenue growth of 20% or more. These are city and country businesses, high street and centre.

Looking more closely at the businesses enjoying growth, it comes from hard work in the business, relentless hard work.

OVERALL PERFORMANCE DATA.

- Customer traffic. 75% of newsagents report average decline of 6%.

- Overall sales. 59% reported an average revenue decline of 3%.

- Basket depth. 66% report a 2.5% decrease in basket size.

- Basket dollar value. 62% report a decrease in basket value of 3%.

It is in the overall business gross profit numbers where the differences in businesses can be seen. Of this latest dataset: 64% sit in the traditional newsagency GP performance band of 28% – 30%. 7% sit below 28%. 20% sit in the GP band of 30% and 35%. 7% sit between 35% and 40%. The rest, 2%, have a GP of more than 40%.

GP is a function of what you stock and the type of shoppers you attract to the business. Buying is where it starts.

WHAT IS DRIVING THE DECLINES?

I think the traffic decline is being driven by a decline in interest in legacy products on which traditional newsagency businesses have relied. I have said for years it is crucial newsagents have a strategy to drive net new traffic. Relying on legacy product to sell new products is not a plan. You need to source new products and to use these to attract people to your business who would otherwise not have shopped with you.

We can grow sales of legacy products by bringing people into our businesses from other reasons. Once in-store some will buy papers and magazines.

HOW TO RESPOND TO TRAFFIC DECLINES?

Any newsagency business can be successful, regardless of location and situation. This is truer today than at any time in the past thanks to what we can see being achieved online – not only in newsagency businesses but through other retail channels.

The key to success is to not run the business as a newsagency. That’s is, to not obsess about legacy products. Focus on new traffic products. Focus on price points you would usually say would never work in your business. Buy products you think will never work. Be radical and through discover what is possible in your business.

I urge you to ask yourself daily, what have I done today to reach a new shopper, someone who does not know we exist? This is what successful businesses in the benchmark study are doing and doing well.

DOES THE NEWSAGENCY CHANNEL HAVE A FUTURE?

I ask this every quarter. My answer has changed – not in the form Australians identify as a newsagency.

AGENCY IS OVER.

There is no upside in any agency parts of the business. People saying they are proud to be called a newsagent are entitled to their view. History will show that era is behind us.

OPTIMISTIC.

I am optimistic for my own businesses and for the businesses of many newsagents.

WHY I DO THIS STUDY

My interest in the study is as a newsagent and as a supplier to the channel through Tower Systems and through newsXpress. I want the channel to grow for selfish reasons and because it has been my life since 1981. I am invested.

BENCHMARK GOALS

I am often asked for benchmark goals newsagents ought to aim for. Here are some benchmarks I have developed in my work with newsXpress and through Tower Systems:

- Gross profit: this is the goal gross profit for all product sales not taking into account any revenue or costs related to any agency business. The traditional newsagency average sits at 28% to 32%. For a newsagency focused on the future, the goal has to be at least 45%.

- Ratio of Gift revenue to Card revenue: 50% minimum. The goal ought to be 100% or more. If you do $100K a year in cards, target to do $100K in gifts, or more.

- Revenue per employee – $250 an hour minimum not including agency revenue. This is a contentious KPI. If you think it is not for you, work the numbers back and see what your number needs to be based on each labour hour in the business.

- Revenue PSQM $4,500 – $8,500 depending on country vs. city / high street to shopping centre and depending of product mix. Higher GP lower revenue required.

- Overall revenue mix percentage targets: Cards: 25%; Gifts/toys/plush: 25%; Stat: 10%; magazines/newspapers: 20%; other: 15%.

- FLOORSPACE ALLOCATION: Cards: 25%; Gifts/toys/plush: 25%; Stat: 8%; magazines/newspapers: 15%; other products: 15%; office/back room / counter: 12%. It’s rare you make money from an office or store room.

- Mark-up goals: Stationery: 125%; Gifts 110%; plush: 110%.

- Occupancy cost: between 9% and 11% of revenue where revenue is product revenue plus commission from agency lines. Location and situation are a big factor in this benchmark. For example, a large shopping centre business will have a higher cost than a high street situation.

- Labour cost: between 9% and 11% of revenue where revenue is product revenue plus commission from agency lines. Labour cost should include fair market costs for all who work in the business. (See above).

Mark Fletcher.

Email: mark@towersystems.com.au Website: www.towersystems.com.au

Beware social media consultants

A small business retailer told me last week they were paying a social media consultant $500 a month for Facebook and Instagram posts. The agreement called for two posts a week. The consultant overdelivered with there to each platform a week.

Six months in to the agreement and the retailer was concerned as they were not seeing any result in revenue.

While the likes for posts were good and likes for the business Facebook page had grown considerably, there was no tangible benefit, no new faces, no in-store mentions of the posts.

In my opinion, social media posts are best if they come from within the business, are simple, entertaining and serve to pitch the business against whats people would assume the business to offer.

Paying a consultant to write posts is dead money as no one can speak for your business sin such an immediate and interactive platform as you and those who work in the business with you.

It is easy to spot social media posts by an agency or social media consultant. It is overthought, often bland, smelling commercial and, usually, overwritten.

Social media consultants can make a strong pitch, helping you with something you may not understand, making it seem easy, coming across as the expert, winning you over with marketing charm.

When it comes to small business social media engagement, the experts are those in small businesses doing it successfully, doing it with a direct revenue benefit. While there may be some consultants achieving this, I am skeptical there would be many.

Sure it is an extra task to complete. The thing is, in today’s world, it is probably the single most important marketing task for the business.