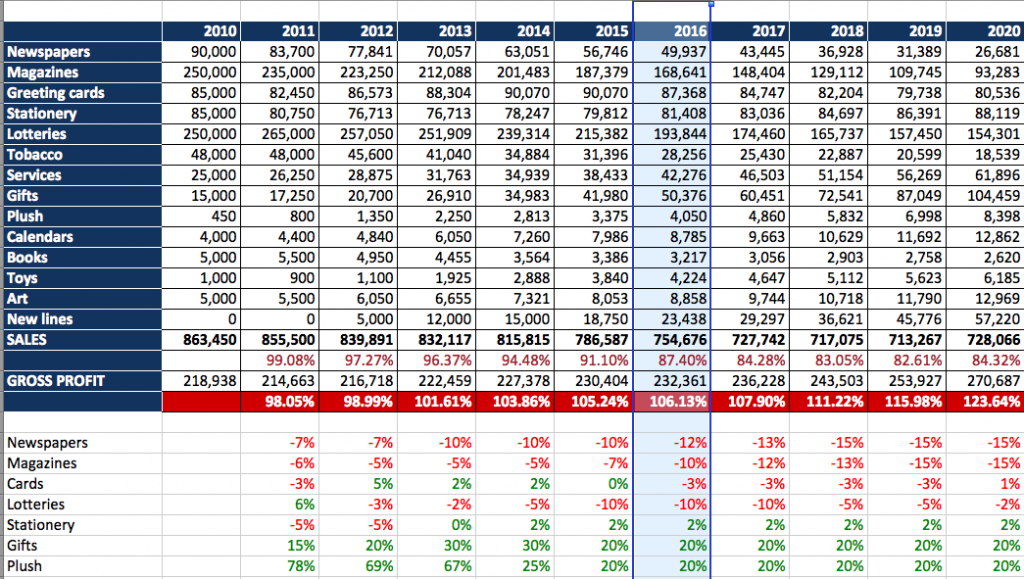

I created this forecast in 2009 anticipating revenue by category for a blended average retail newsagency to cover the 2010 to 2020 period.

I have shared it several times here as well at newsagency conferences and Newsagency of the Future workshops over the years.

With 2016 drawing to a close, except for lotteries (shown as commission and not takings) in some locations and stationery overall, the projection continues to prove to be accurate.

I am not happy about it being accurate. I’d rather magazine, newspaper and some other revenue categories to be growing, not declining.

Looking at the projected 2016 column now, some categories reflected my hope in 2009 for transition by 2016. Additional traffic from gifts, toys, plush and new lines was key to achieving the projected GP and GP as a percentage of revenue.

We can look at the changes happening in and around our businesses as if a bystander watching a parade or we can jump in and influence how things go in our businesses. I prefer to jump in. Indeed, I prefer to be ahead of changes where possible.

I hope newsagents resolve 2017 to be the year then bring on change in their businesses, big change, whole of business change.

Doing what you have been doing will ensure you see a continuation of the results you have been achieving.

I have shared the table above as encouragement for newsagents to reflect on 2016 compared to previous yearend to contemplate what can be achieved in 2017. The forecast has guide all of my own business decisions as they relate to the newsagency channel. It has stood me in good stead.

Well done Mark, I’m absolutely sure its been a hard 6 years in transition. Here’s the sobering thought…with rent increases of up to 5% Per Annum, wages up say 3%, utilities and outgoings well up as well as higher theft rates, breakages and markdowns from the gift mix increase then at best you’ve marked time or maybe your bottom line actually maybe worse off than in 2010. If you’ve got best practice and you’re in the minority of the 3000 odd newsagent industry then heavan help the rest!

My understanding is these numbers are the origininal projections. It would be more meaningful to have the actuals to 2016 to compare with.

Colin, as you have heard me say at Newsagency of the Future sessions you have attended, each year, for the key traffic drivers of newspapers, magazines, cards, stationery and tobacco the projections have been accurate. This looks like being the case for 2016.

Ken, the key is in the transition to higher GP product. Back in 2009 the average GP% for a traditional newsagency was 28% to 32%. Newsagents who embraced the change I have banged on abut here should currently be sitting at between 40% and 45%. This is, in part, what helps them deal with the price increases you note.

Mark, projections are projections, they are not facts. If the table above is projections made 6 years ago, they cannot be quoted as fact. Forecasting accuracy is measured by reporting actual results against projections. Stating that projections have proved to be accurate without quoting the actuals has no value.

I was not in this industry in 2010 and any projections made then and repeated now have zero value today to anybody who joined the industry after 2010. I certainly have no understanding what “new lines” are.

I don’t dispute the trend or the accuracy of your foresight in 2010, but without updating for known results, I question the tables relevance to today.

Colin the projections I forecast in 2009 proved to be accurate in the first six years and by September 2016 they were accurate for the seventh. The only update needed at this point is the last quarter of 2016.

Mark your strategy to transition the newsagency channel is clearly correct, but there are bigger forces at play.

The two that are most significant are bricks and mortar retail trends in combination with delusional land lords.

Even in the best practice instance you have detailed above, overall sales are down 13% since 2010.The offer transition has resulted in a 5.9% lift in GP or $13k which is a great result.

The problem is in 2010, rent at 12% of income was $100k per annum and wages at 10% was $90k. With annual increases, rent in 2016 is $130k and wages is $105k. Thats before utilities, insurance, bank fees etc.

In other words, whilst GP is up $13, holding costs have increased by $45k to $50k.

This business is $30k per annum worse off today than it was 6 years ago and in the scale of the business this is a huge unsustainable decline.

The challenges exist not only in the channel, but in the broader retail environment. My gut feel is that from 4500 in 2010, less than 1000 will make to 2020.

James back in 2009 I anticipated a lower labour cost by 2016 with hours cut as agency business was reduced. I also anticipated a more efficient supply chain with little or no stock held in a storeroom, improving the return on inventory investment.

The only way to reset lease costs is to negotiate by either moving or getting a better deal in the current situation. This is difficult. However, I have seen it done with small business landlords and with majors.

The key is to appeal more broadly than before.

Also, an active online strategy is vital to tap into shoppers way outside your area.

In terms of 2020, I suspect we will end up at somewhere between 1,500 and 1,900.